«When is the CFA® exam?» is one of the first questions you want to be answered if you’re planning to sit for the exam. This article has information about the CFA exam dates and schedules for each exam level.

TABLE OF CONTENTS

- CFA Exam Dates

- CFA Exam Cost

- How To Register For The CFA Exam

- What To Bring On CFA Exam Day

CFA Exam Schedule: A Regular Cadence for CFA Exam Dates and Schedules

In 2023, the CFA Institute will offer the CFA exam on a regular schedule. Level I will be offered four times a year in February, May, August, and November 2023. Level II will be offered three times a year in May, August/September, and November 2023. Level III of the CFA exam will be offered twice a year in February and August/September 2023.

2023 CFA® Exam Dates

The specific CFA exam windows/dates for each level of the CFA Program are as follows:

2023 CFA Level l Exam Dates

Level I Exam Date Window |

Registration Deadline |

Scheduling Deadline |

Rescheduling Deadline |

| February 14-20, 2023 | November 8, 2022 | November 16, 2022 | January 13, 2023 |

| May 16-22, 2023 | January 31, 2023 | February 15, 2023 | April 14, 2023 |

| August 22-28, 2023 | May 9, 2023 | May 24, 2023 | July 21, 2023 |

| November 11-17, 2023 | August 8, 2023 | August 16, 2023 | October 13, 2023 |

2023 CFA Level ll Exam Dates

Level II Exam Date Window |

Registration Deadline |

Scheduling Deadline |

Rescheduling Deadline |

| May 23-27, 2023 | January 31, 2023 | February 15, 2023 | April 21, 2023 |

| August 29 — Sept 2, 2023 | May 9, 2023 | May 24, 2023 | July 28, 2023 |

| November 18-22, 2023 | August 8, 2023 | August 16, 2023 | October 20, 2023 |

2023 CFA Level lll Exam Dates

Level III Exam Date Window |

Registration Deadline |

Scheduling Deadline |

Rescheduling Deadline |

| February 21-23, 2023 | November 8, 2022 | November 16, 2022 | January 20, 2023 |

| August 29 — Sept 5, 2023 | May 9, 2023 | May 24, 2023 | July 28, 2023 |

Before you choose your CFA exam date, download this free Before You Decide to Sit for the CFA Exam eBook.

August 2023 CFA Exam Registration Details

How Much Does the CFA Exam Cost?

CFA exam costs vary depending on when you decide to register for the exam but regardless there is a one-time enrollment fee of $350 the first time you register for the Level I exam.

How To Register for the CFA Exam in 2023

The CFA exam is administered to registrants in a computer-based testing format for three levels, which ended 60 years of paper-based testing for Level ll and Level lll. To register for the CFA exam, you must first register with the CFA Institute;

then you will be given the option to schedule your exam during one of the dates provided by the CFA Institute.

Sign up for our CFA question of the day and get a question sent directly to your inbox every day to help you prepare.

What to Bring to the CFA Exam in 2023

The video below lists all materials you are required to bring to your CFA Exam day, plus more materials and supplies that can help you on test day.

Bring these materials to your CFA Exam:

- A valid international passport: this is the only type of identification that will be accepted for admission

- Your CFA Exam Admission Ticket: the CFA Institute will alert you when your ticket is available, at which point you should print it on clean paper

- An approved calculator: the TI BAII Plus or the Hewlett Packard 12C

- Tip: bring extra batteries and a backup calculator, if you have one

- Pencils: multiple sharpened #2 pencils

- High-quality erasers

- Pencil sharpener

- A sweater or jacket in case you get cold in your testing room

- A wristwatch to make timing as simple as possible

- FYI: Smartwatches are not allowed!

- Earplugs to help avoid distractions in your testing room

Do Not Bring these materials to your CFA Exam:

- Food

- Drinks

- Study/prep materials

- Phones

- Tablets

- Computers

- Highlighters

- Correction fluid

- Rulers

- Pencil cases

- Large purses/bags

- Scratch paper

- Unapproved calculators

- Calculator manuals

- Timers

What To Expect On Exam Day >>

Ready To Start Preparing for the CFA Exam?

As you get ready for your next CFA exam, consider making a Kaplan Schweser CFA study materials—complete

with classes, study tools, exam prep study packages, and mock exams—the centerpiece of your mission to earn a passing grade.

Что такое сертификат CFA и чем он отличается от ДипИФР-рус и ACPM

Любите работать с финансами и анализировать информацию, но должность главного бухгалтера — далеко не предел ваших карьерных амбиций? Интересуетесь работой на фондовых биржах? Или хотите стать финансовым консультантом? Тогда в вашем резюме уместно будет смотреться сертификат CFA. Во время подготовки к экзаменам вы получите прочную теоретическую базу знаний. А их успешная сдача подтвердит вашу ценность для работодателей и клиентов.

Рассказываем, что входит в программу подготовки, как проходят экзамены и сколько они стоят (спойлер: цена немаленькая, но есть возможность существенно сэкономить).

Chartered Financial Analyst (CFA) — международный сертификат дипломированного финансового аналитика от CFA Institute, главный офис которого находится в США.

Чаще всего этот сертификат получают финансовые, инвестиционные аналитики и консультанты, портфельные управляющие и CFO. Популярен он и у главных бухгалтеров, стремящихся к карьерному росту и смене деятельности: базовые знания по МСФО и ведению финансов облегчают подготовку к CFA level 1.

Если в резюме кандидата на должность есть строчка о получении такого сертификата, то работодатель уверен в теоретических знаниях и наличии практического опыта в инвестиционной сфере, а также в хорошем владении деловым английским. Последний пункт следует из того, что экзамен сдают только на английском языке.

Из чего состоит

Для получения квалификации CFA нужно сдать экзамены трех уровней.

- Теория учета и анализа финансовой отчетности, корпоративных финансов и рыночных инструментов.

- Оценка активов с учетом изученных на первом уровне инструментов и источников информации.

- Управление инвестиционным портфелем.

Экзаменационные вопросы разделены на 10 тем. Вес каждой темы при определении итоговой оценки разный. Распределение значимости тем показано на диаграммах.

Какие требования к претендентам

На сайте Института сформулированы условия, которым кандидаты должны соответствовать на момент сдачи экзаменов.

- Образование и опыт работы (в любой области, необязательно в финансах). Обязателен один из пунктов:

- наличие бакалаврского диплома колледжа или университета;

- учеба на последнем курсе бакалавриата во время регистрации на экзамен первого уровня, для регистрации на следующие уровни диплом обязателен;

- суммарный стаж работы и учебы в колледже или университете от четырех лет. Учитывается только работа на полную ставку — сроки обучения и работы не должны совпадать.

- Наличие загранпаспорта, действительного на дату сдачи экзамена.

- Соответствие критериям профессионального поведения — кандидаты заполняют специальную анкету.

- Проживание в стране, не подпадающей под санкции, указанные в политике Управления по контролю за иностранными активами. На данный момент к лицам, которые не могут получить сертификат CFA, относятся жители Крымского полуострова.

Чтобы стать членом организации CFA, нужно сдать экзамены всех уровней и получить трехлетний опыт работы с инвестициями или финансовой аналитикой. Опыт можно нарабатывать в процессе подготовки и сдачи экзаменов — по последним требованиям института перерыв между экзаменами должен быть не менее 6 месяцев.

Как подготовиться к экзамену CFA

CFA Institute разработал рекомендации и материалы для подготовки к экзамену, однако не проводит подготовительные занятия. Готовиться можно самостоятельно, либо на курсах сторонних организаций.

Институт дает советы, как выбрать качественного поставщика услуг по подготовке к экзамену. На сайте также опубликован список официальных провайдеров, но организаций, расположенных в странах СНГ, среди них нет.

Потратить на подготовку к одному уровню, по подсчетам Института, придется около 300 часов. Необходимо не только изучить теорию, но и попрактиковаться в решении задач. К практической части стоит отнестись очень серьезно, поскольку во время экзамена нужно быстро ориентироваться в заданиях. Чтобы успеть ответить на все вопросы, на один надо тратить не более 90 секунд.

Что собой представляет экзамен

Экзамены проходят в тестовых центрах Института, ближайшие из которых находятся в Киеве и Москве. Формат их проведения недавно изменился — сейчас это тестирование на компьютере. Брать с собой на экзаменационное место можно только калькулятор. В кабинете находятся администраторы, контролирующие честность претендентов на сертификат.

Экзамен достаточно сложный и его в среднем сдают меньше половины претендентов. Теперь обо всем подробнее.

Правила проведения

До пандемии экзамены сдавали в один день по всему миру в бумажном формате: два раза в год для первого уровня и по одному разу для второго и третьего уровней. Длительность — 6 часов с одним часовым перерывом.

С 2021 года правила сдачи экзаменов CFA изменились. Они также проходят в тестовых центрах, но в форме компьютерного тестирования. Длительность экзамена сократили до 4,5 часов с 30-минутным отдыхом по желанию участника. Взять с собой на тестирование можно только калькулятор определенных моделей.

Формат заданий для разных уровней и время проведения экзаменов CFA приведены в таблице.

| Уровень | I | II | III |

| Задания | 240 вопросов с вариантами ответов | ситуационные задачи с вариантами ответов | ситуационные вопросы с вариантами ответов + вопросы с ответами в виде кратких эссе |

| Экзаменационная сессия | февраль, май, август, ноябрь | февраль, август | май, ноябрь |

На каждую сессию выделено 10-дневное окно. В его пределах кандидат выбирает любой день экзамена. То есть для регистрации кандидатам надо:

- зарегистрироваться на сайте и оплатить взносы;

- забронировать дату в рамках сессионного окна.

Стоимость экзамена CFA

При первоначальной регистрации на экзамен первого уровня взимается единоразовый взнос — 450 $. Стоимость сдачи каждого экзамена в 2021 году составляет 700 $ при ранней регистрации и 1000 $ — при стандартной. Сроки ранней и стандартной регистрации для каждой сессии указаны на сайте CFA Institute.

Институт дает возможность подать заявку на стипендию. Участники, которые пройдут отбор, освобождаются от вступительного взноса и платят за экзамен 250 или 350 $ в зависимости от конкретной программы.

Виды стипендий:

- Доступная — для лиц, которые не могут позволить себе оплату программы. Кандидаты должны соответствовать всем требованиям для зачисления в программу CFA.

- Женская — для женщин, которые заинтересованы в получении сертификата и не имеют права на получение других стипендий Института CFA.

- Студенческая — для студентов, которые учатся в одном из дочерних университетов. В списке есть 4 российских, 4 украинских и 1 казахский университет.

- Профессорская — для штатных преподавателей, администраторов, заведующих кафедрами колледжей и университетов, которые преподают минимальное количество кредитных часов в соответствующих учреждениях.

- Стипендия регулятора — для сотрудников финансовых регуляторов, центральных банков, комиссий по ценным бумагам, фондовых бирж или государственных организаций.

- Стипендия СМИ — для штатных или контрактных сотрудников медиаорганизаций, которые сообщают и распространяют финансовые новости, данные и информацию об образовании.

Положительный результат экзамена

Результаты по каждой теме экзамена суммируются по секретной формуле Института. Потом собирают результаты всех кандидатов, участвовавших в сессии, и определяют проходной балл. То есть нет фиксированного проходного балла, а только уровень относительно других претендентов.

По разным комментариям, для успешной сдачи экзамена нужно правильно ответить примерно на 70% вопросов. При этом по каждой должно быть не менее 50% правильных ответов.

По статистике за 2010–2019 год, доля участников, успешно сдавших экзамен, составила:

- на первом уровне — 41%;

- на втором — 44%;

- на третьем — 53%.

Какие еще варианты сертификаций

Квалификация CFA наиболее востребована на фондовых рынках и в хедж-фондах. Если эти сферы не привлекают, но вы думаете о развитии карьеры, то есть другие сертификации. Безумно влюблены в цифры и бухгалтерскую деятельность? Обратите внимание на диплом ДипИФР-рус от АССА. Считаете, что пора переходить на руководящие должности и ищете, какие навыки подтянуть и где это сделать? Изучите нашу программу подготовки «Профессиональный финансовый директор» от британской Академии ACPM. Краткое сравнение сертификаций приведено в таблице ниже.

| CFA | ДипИФР-рус от ACCA | ACPM: Профессиональный финансовый директор | |

| Организация, страна | CFA (Chartered Financial Analyst) Institute — Международный институт дипломированных финансовых аналитиков, США | АССА (Association of Chartered Certified Accountants) — Ассоциация Дипломированных Сертифицированных Бухгалтеров, Великобритания | ACPM Academy of Certified Professional Managers – британская Академия сертифицированных профессиональных менеджеров, Великобритания |

| Для кого | Для финансовых, инвестиционных аналитиков и консультантов, портфельных управляющих и финансовых директоров | Подходит как бухгалтерам, аудиторам, консультантам по МСФО, так и топ-менеджерам, желающим углубить свои знания в области МСФО | Для главных бухгалтеров и финансовых менеджеров, коммерческих директоров и руководителей подразделений, аудиторов и экономистов |

| Требования к кандидату | Образование и опыт работы (в любой области, необязательно в финансах):

Хорошее владение деловым английским. |

|

Нет |

| Срок получения диплома | Минимум полгода на один экзамен | 3-12 месяцев с обучением | До 12 месяцев вместе с обучением |

| Как получить | Пройти обучение самостоятельно или на курсах и сдать три экзамена в сертифицированном центре | Пройти обучение по программе АССА ДипИФР(рус) и сдать 1 экзамен в сертифицированном центре | Пройти обучение по программе ACPM: ПФД и сдать 3 онлайн-экзамена. При успешной сдаче можно получить 4 диплома ACPM |

| Экзамен | Компьютерное тестирование. Длительность: 4,5 часа | Письменный. Длительность: 3 часа и 15 минут. Экзаменационные вопросы включают расчетные и аналитические элементы. Экзамен проходит 2 раза в год: в июне и декабре |

Каждый экзамен состоит из тестовой и практической части. Длительность: 3 часа |

| Экзамен | от 700 $ за один уровень | 122 фунта | около 120 фунтов |

Что в итоге

Сертификат CFA подходит для тех, кто хочет работать в области инвестиций и финансовой аналитики. Экзамен проводится только на английском языке, поэтому нужен хороший уровень делового английского. Стоимость: 450 $ — первоначальный взнос и 700/1000 $ — за один экзамен в зависимости от даты регистрации.

Для тех, в чьи планы не входит работа на фондовых рынках, существуют другие международные программы сертификации. Они более выгодны по цене. А главное их преимущество — обучение и сдача экзаменов проходят на русском языке.

Стремитесь к карьерному росту и ищете курсы повышения квалификации? Наша Академия предлагает подготовку по различным международным программам сертификации. Пройдите бесплатный первый урок по любому курсу, чтобы оценить качество и удобство обучения!

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

If you plan on pursuing a career as a chartered financial analyst (CFA), you’ll need to pass a series of three comprehensive exams. The CFA exam measures and certifies your competence and integrity before becoming a financial analyst. In passing the CFA exam, you’ll gain analytical skills and expertise in quantitative methods, economics, financial reporting, investments analysis, and portfolio management. The exam is meant to help you enhance your career or help you find a new role in the finance sector.

To prepare for these exams, many candidates use prep course products to complement their self-study from the Institute’s materials or as a complete alternative to using those materials. So, candidates should focus on the products that they really need, given their own circumstances. There are five distinct categories of product, including self-study with books/e-books, questions and mock exams, in-person or online instruction, pre-test review, and tutoring.

To best help you feel ready for the exam, we assessed the best CFA prep courses to get you across the finish line.

The 7 Best CFA Exam Prep Courses of 2023

-

Most Established:

Kaplan/Schweser

-

Most Price Options:

Wiley Efficient Learning

-

Best Course Design:

The Princeton Review

-

Newest:

Salt Solutions

-

Most Versatile:

Bloomberg Exam CFA Prep

-

Best for Self-Directed Learners:

FinQuiz

-

Best Tutoring Option:

MyGuru

Most Established

:

Kaplan/Schweser

Kaplan/Schweser is the largest and most established provider, offering its products in packages that increase in price accordingly.

The basic self-study package lists for about $699 and features notes, practice exams, questions, and planning tools. The top-level package adds OnDemand instruction and access to an OnDemand Review Workshop for a total price of $999.

Kaplan/Schweser also sells access weekend and week-long review packages as standalone products, which is great if you’ve relied solely on self-studying and would like a new tactic.

Weekend reviews are about bringing everything together and focusing on exam strategy rather than instruction. The week-long session is about review and instruction since the latter is unlikely to be enough on its own.

Most Price Options

:

Wiley Efficient Learning

Wiley Efficient Learning offers layers of packages that increase in price by how many materials you need. The standalone self-study course costs around $645 and notably includes questions and two mock exams. For about $995, you can get instruction in a live-on-line or video format, as well as the right to email questions to an instructor, flashcards, and other goodies.

For $1,395, Wiley throws in a review course, including an online class, a mock, and a book. There are fewer hours of video lectures and questions as candidates progress through the three exams. For tutoring, candidates get responses from instructors within 24 to 48 hours.

Wiley’s CFA offerings are up-to-date and don’t contain questions about topics long-gone from the curriculum.

Best Course Design

:

The Princeton Review

The Princeton Review offers incredibly well designed CFA courses to help financial professionals prepare for this difficult series of exams. Like Kaplan, The Princeton Review is a well-known name when it comes to test prep.

The Princeton Review offers prep courses for the 3 levels of the CFA exam. At the time of this review, levels 1 and 3 packages are being offered at a discounted rate of $599 each, and level 4 is offered at $499, all down from the usual price of $799. All courses come with money back assurances and students can complete a 7-day free trial before paying any money for a full course.

Practice exams are an extremely important part of preparing for the CFA exam, so students will like that practice exam scores are made available immediately upon completion. Students will also find the in-depth test score analytics helpful for identifying areas where improvement is needed.

Students can ask for assistance from experienced teachers at any time and personal tutoring is available from The Princeton Review teachers at a rate of $200 an hour. Course extensions are available if any students can’t finish within 12 months.

Newest

:

Salt Solutions

A newer option for CFA exam prep, Salt Solutions launched its Beta platform for CFA Level I exam prep in late 2020. The company is now officially out of Beta, and the full CFA learning experience is available for Levels I and II (Level III will be available in 2022).

Salt Solutions knows it’s tough to stay focused on a large volume of material with limited study time, so it breaks it into small chunks to complete in 10 to 30 minutes. Salt Solutions also improves the study process by showing you which steps are most important. While the platform offers flexibility, the scheduler also sets weekly goals to keep you on track.

The platform has a user-friendly interface with a light or dark mode, making it easier on your eyes after long hours of studying. The platform currently includes assignment questions, downloadable videos, and a scheduler with weekly goals to stay on track.

Although Salt Solutions doesn’t have a proven track record yet, the user-friendly and thoughtfully designed software looks promising, particularly for those tired of staring at textbooks. Passing all three CFA exams isn’t easy, and Salt Solutions may be a good option for those struggling to buckle down and focus.

Most Versatile

:

Bloomberg Exam CFA Prep

Bloomberg Exam CFA Prep provides a modern, AI-based learning platform that aims to help identify and focus attention on your weak areas.

The self-study and instruction-based package costs around $700 and gives you access to “micro-lessons” on the entire curriculum. You will also get variable amounts of access to practice questions and instructors, depending upon any add-ons you choose.

The base package includes 10,000+ questions—more than its competitors—seven full exams and the ability to message an instructor 20 questions. With the Ultimate package, priced at around $2,000, you’ll receive four more exams, unlimited question-messaging, and five private tutoring sessions.

Bloomberg is also a great option if you’re cramming since it offers packages for sprinters—approximately $500 for two months’ access right before the exams. There are also bundles for marathoners, who can get four years’ worth of access for about $1,300.

Best for Self-Directed Learners

:

FinQuiz

FinQuiz is a great choice for self-directed candidates looking for an affordable complement to working directly from the CFA test materials.

The service provides a variety of options but emphasizes what the exam is expected to ask. Products available for you to use via FinQuiz are an online question bank, chapter notes, smart summaries, six mock exams, formula sheets, and a study plan.

FinQuiz’s basic program—priced at $299—is just questions and mocks, which are deliberately challenging and designed to stretch the candidates. If you have more budget to spare, FinQuiz has a premium package for approximately $599, which provides access to detailed summaries of the company’s materials and an active learning study plan.

Best Tutoring Option

:

MyGuru

MyGuru offers affordable, individual tutoring from CFA charter holders, either in person or online. Candidates get a lot of flexibility with tutors, both in terms of when and how it takes place and also with regards to how many sessions are purchased.

Tutoring is often used as a supplement to in-person or online self-study, or an instructional course. An individual teacher is there to help you create a more customized study plan out of whatever materials or curriculum exists and focus on the topics and concepts that might be challenging. Of course, they can also become a mentor to you and help build confidence leading up to the exam date.

In contrast to online courses that include access to an instructor or mentor as part of a package in advance, you will get to choose how many lessons you need as you study. Plus, you will get personalized attention dedicated to your specific concerns. Costs vary but typically do not exceed $179 per hour, with lower pricing offered when students invest in a package of hours.

When Can I Take the CFA Exam?

If you’re planning to take the CFA exam, they take place at different times throughout the year. To find a test date that works for you, check out the CFA Institute’s website.

How is the CFA Exam Framed?

The CFA Institute’s tests are mostly multiple-choice, and candidates have various options for how to prepare. The CFA exam consists of a series of three tests: Levels I, II, and III. On the Level I exam, you can expect questions to be focused on basic knowledge and comprehension around investment tools, while the Level II test is centered on a more complex analysis of valuing assets. The Level III exam is application-based, challenging you to think more analytically about portfolio management and wealth planning.

How Can I prepare for the CFA Exam?

If you’re planning to take the CFA exam, it’s important to consider taking courses to ensure you’re as prepared as possible. With several choices in the test-prep landscape, it’s necessary to consider your learning style, budget, and time constraints. It’s also important to note that these are all subject to change during the journey to passing the exams.

One option is to prepare directly from the CFA Institute’s materials, which are free with every paid registration (around $700 to $1,000). As these materials are the Institute’s curriculum, they are effectively the font from which the exams are crafted.

But the materials can be excessively long for the readings and excessively short for questions. They tend to be more theoretical than instructional and fail to break up topics or focus attention on what is essential for success within a pass-fail multiple-choice exam. Moreover, using these materials means primarily book-based preparation, which is unappealing to visual or auditory learners.

Is Getting a CFA Worth It?

If you’re looking to advance your career in finance, the CFA exam is definitely worth taking. Considering the markets are always changing, becoming a certified CFA will provide you with a solid base of knowledge and opportunity to pursue a variety of jobs, including a relationship manager, research analyst, chief executive, financial advisor, corporate financial analyst, and more.

How We Chose the Best CFA Prep Courses

To help determine which CFA prep course is best for you, we compared which services stood out regarding pricing, value, packages, online and in-person course options, and the ability to purchase study materials individually. We also looked into how customizable the companies’ services were and which companies would offer money-back guarantees.

fizkes / Getty Images

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

If you plan on pursuing a career as a chartered financial analyst (CFA), you’ll need to pass a series of three comprehensive exams. The CFA exam measures and certifies your competence and integrity before becoming a financial analyst. In passing the CFA exam, you’ll gain analytical skills and expertise in quantitative methods, economics, financial reporting, investments analysis, and portfolio management. The exam is meant to help you enhance your career or help you find a new role in the finance sector.

To prepare for these exams, many candidates use prep course products to complement their self-study from the Institute’s materials or as a complete alternative to using those materials. So, candidates should focus on the products that they really need, given their own circumstances. There are five distinct categories of product, including self-study with books/e-books, questions and mock exams, in-person or online instruction, pre-test review, and tutoring.

To best help you feel ready for the exam, we assessed the best CFA prep courses to get you across the finish line.

The 7 Best CFA Exam Prep Courses of 2023

-

Most Established:

Kaplan/Schweser

-

Most Price Options:

Wiley Efficient Learning

-

Best Course Design:

The Princeton Review

-

Newest:

Salt Solutions

-

Most Versatile:

Bloomberg Exam CFA Prep

-

Best for Self-Directed Learners:

FinQuiz

-

Best Tutoring Option:

MyGuru

Most Established

:

Kaplan/Schweser

Kaplan/Schweser is the largest and most established provider, offering its products in packages that increase in price accordingly.

The basic self-study package lists for about $699 and features notes, practice exams, questions, and planning tools. The top-level package adds OnDemand instruction and access to an OnDemand Review Workshop for a total price of $999.

Kaplan/Schweser also sells access weekend and week-long review packages as standalone products, which is great if you’ve relied solely on self-studying and would like a new tactic.

Weekend reviews are about bringing everything together and focusing on exam strategy rather than instruction. The week-long session is about review and instruction since the latter is unlikely to be enough on its own.

Most Price Options

:

Wiley Efficient Learning

Wiley Efficient Learning offers layers of packages that increase in price by how many materials you need. The standalone self-study course costs around $645 and notably includes questions and two mock exams. For about $995, you can get instruction in a live-on-line or video format, as well as the right to email questions to an instructor, flashcards, and other goodies.

For $1,395, Wiley throws in a review course, including an online class, a mock, and a book. There are fewer hours of video lectures and questions as candidates progress through the three exams. For tutoring, candidates get responses from instructors within 24 to 48 hours.

Wiley’s CFA offerings are up-to-date and don’t contain questions about topics long-gone from the curriculum.

Best Course Design

:

The Princeton Review

The Princeton Review offers incredibly well designed CFA courses to help financial professionals prepare for this difficult series of exams. Like Kaplan, The Princeton Review is a well-known name when it comes to test prep.

The Princeton Review offers prep courses for the 3 levels of the CFA exam. At the time of this review, levels 1 and 3 packages are being offered at a discounted rate of $599 each, and level 4 is offered at $499, all down from the usual price of $799. All courses come with money back assurances and students can complete a 7-day free trial before paying any money for a full course.

Practice exams are an extremely important part of preparing for the CFA exam, so students will like that practice exam scores are made available immediately upon completion. Students will also find the in-depth test score analytics helpful for identifying areas where improvement is needed.

Students can ask for assistance from experienced teachers at any time and personal tutoring is available from The Princeton Review teachers at a rate of $200 an hour. Course extensions are available if any students can’t finish within 12 months.

Newest

:

Salt Solutions

A newer option for CFA exam prep, Salt Solutions launched its Beta platform for CFA Level I exam prep in late 2020. The company is now officially out of Beta, and the full CFA learning experience is available for Levels I and II (Level III will be available in 2022).

Salt Solutions knows it’s tough to stay focused on a large volume of material with limited study time, so it breaks it into small chunks to complete in 10 to 30 minutes. Salt Solutions also improves the study process by showing you which steps are most important. While the platform offers flexibility, the scheduler also sets weekly goals to keep you on track.

The platform has a user-friendly interface with a light or dark mode, making it easier on your eyes after long hours of studying. The platform currently includes assignment questions, downloadable videos, and a scheduler with weekly goals to stay on track.

Although Salt Solutions doesn’t have a proven track record yet, the user-friendly and thoughtfully designed software looks promising, particularly for those tired of staring at textbooks. Passing all three CFA exams isn’t easy, and Salt Solutions may be a good option for those struggling to buckle down and focus.

Most Versatile

:

Bloomberg Exam CFA Prep

Bloomberg Exam CFA Prep provides a modern, AI-based learning platform that aims to help identify and focus attention on your weak areas.

The self-study and instruction-based package costs around $700 and gives you access to “micro-lessons” on the entire curriculum. You will also get variable amounts of access to practice questions and instructors, depending upon any add-ons you choose.

The base package includes 10,000+ questions—more than its competitors—seven full exams and the ability to message an instructor 20 questions. With the Ultimate package, priced at around $2,000, you’ll receive four more exams, unlimited question-messaging, and five private tutoring sessions.

Bloomberg is also a great option if you’re cramming since it offers packages for sprinters—approximately $500 for two months’ access right before the exams. There are also bundles for marathoners, who can get four years’ worth of access for about $1,300.

Best for Self-Directed Learners

:

FinQuiz

FinQuiz is a great choice for self-directed candidates looking for an affordable complement to working directly from the CFA test materials.

The service provides a variety of options but emphasizes what the exam is expected to ask. Products available for you to use via FinQuiz are an online question bank, chapter notes, smart summaries, six mock exams, formula sheets, and a study plan.

FinQuiz’s basic program—priced at $299—is just questions and mocks, which are deliberately challenging and designed to stretch the candidates. If you have more budget to spare, FinQuiz has a premium package for approximately $599, which provides access to detailed summaries of the company’s materials and an active learning study plan.

Best Tutoring Option

:

MyGuru

MyGuru offers affordable, individual tutoring from CFA charter holders, either in person or online. Candidates get a lot of flexibility with tutors, both in terms of when and how it takes place and also with regards to how many sessions are purchased.

Tutoring is often used as a supplement to in-person or online self-study, or an instructional course. An individual teacher is there to help you create a more customized study plan out of whatever materials or curriculum exists and focus on the topics and concepts that might be challenging. Of course, they can also become a mentor to you and help build confidence leading up to the exam date.

In contrast to online courses that include access to an instructor or mentor as part of a package in advance, you will get to choose how many lessons you need as you study. Plus, you will get personalized attention dedicated to your specific concerns. Costs vary but typically do not exceed $179 per hour, with lower pricing offered when students invest in a package of hours.

When Can I Take the CFA Exam?

If you’re planning to take the CFA exam, they take place at different times throughout the year. To find a test date that works for you, check out the CFA Institute’s website.

How is the CFA Exam Framed?

The CFA Institute’s tests are mostly multiple-choice, and candidates have various options for how to prepare. The CFA exam consists of a series of three tests: Levels I, II, and III. On the Level I exam, you can expect questions to be focused on basic knowledge and comprehension around investment tools, while the Level II test is centered on a more complex analysis of valuing assets. The Level III exam is application-based, challenging you to think more analytically about portfolio management and wealth planning.

How Can I prepare for the CFA Exam?

If you’re planning to take the CFA exam, it’s important to consider taking courses to ensure you’re as prepared as possible. With several choices in the test-prep landscape, it’s necessary to consider your learning style, budget, and time constraints. It’s also important to note that these are all subject to change during the journey to passing the exams.

One option is to prepare directly from the CFA Institute’s materials, which are free with every paid registration (around $700 to $1,000). As these materials are the Institute’s curriculum, they are effectively the font from which the exams are crafted.

But the materials can be excessively long for the readings and excessively short for questions. They tend to be more theoretical than instructional and fail to break up topics or focus attention on what is essential for success within a pass-fail multiple-choice exam. Moreover, using these materials means primarily book-based preparation, which is unappealing to visual or auditory learners.

Is Getting a CFA Worth It?

If you’re looking to advance your career in finance, the CFA exam is definitely worth taking. Considering the markets are always changing, becoming a certified CFA will provide you with a solid base of knowledge and opportunity to pursue a variety of jobs, including a relationship manager, research analyst, chief executive, financial advisor, corporate financial analyst, and more.

How We Chose the Best CFA Prep Courses

To help determine which CFA prep course is best for you, we compared which services stood out regarding pricing, value, packages, online and in-person course options, and the ability to purchase study materials individually. We also looked into how customizable the companies’ services were and which companies would offer money-back guarantees.

fizkes / Getty Images

The cohort sitting for their examinations in November 2021 is the last lot of candidates to be examined using the CFA Program 2020 curriculum, the curriculum that has been in force for the last two years. Normally, CFA Institute reviews its curriculum yearly. However, due to the disruption caused by the coronavirus pandemic, the Institute did not update its curriculum in 2021. This notwithstanding, we are delighted to inform you that major changes have been announced in regard to the 2022 curriculum. Stay tuned and you shall find out more shortly.

Who Needs to Know about these Changes?

Deferring Candidates

Deferring candidates will be tested on the new curriculum. In this respect, there is a caveat that calls for your attention: CFA institute no longer accepts deferral applications submitted via email. Deferral requests have to be made on CFA Institute’s website. For any such request to pass the validity threshold, it has to be occasioned by any of these reasons: pregnancy, mandatory military service during a candidate’s test window, rescheduling of the examinations by Prometric, death of a member of a candidate’s family, a life-threatening illness has affected a candidate or a member of their family, and if a candidate has been exposed to or contracted COVID 14 days before their examinations.

Since they will be tested on the new curriculum, deferring candidates should make a point of going through the entire 2022 curriculum. Alternatively, they can use the old curriculum for the readings that are still intact and incorporate the added learning objectives in their studies.

New Candidates

Are you a candidate aspiring to start the CFA Program? Here is news for you: Early registration is now open for candidates wishing to write their level I exams in May 2022. New candidates will be examined using the 2022 curriculum. In their preparation for the examinations, a new candidate should ensure that they use the revised notes. At AnalystPrep, we provide you with top-notch updated study materials, video lessons, and access to over 4,000 practice questions. Aside from all these, we offer mock examinations and an interactive student forum to make your learning experience easy and memorable.

Returning candidates

The new curriculum will be used to examine candidates who failed their examinations. While preparing to retake their examinations, such candidates can go through the whole curriculum. Also at their disposal is the option of using their old study notes. They must, however, ensure they pay utmost attention to the newly introduced learning objectives and completely ignore those that have since been expunged.

https://analystprep.com/shop/cfa-unlimited-package-for-level-1-2-3/

Topic Weightings

There are no changes in the topic weights. CFA Institute made major changes to the topic weightings in the 2020 curriculum by converting the topic weightings into a range rather than a number. This is a complete departure from what has been the case over the years. The Institute’s decision to revise the topic weightings was premised upon the need to dissuade candidates from ignoring topics with smaller percentages (for example, Alternative Investments and Derivatives) and focusing more, instead, on others with higher percentages (for example, Quantitative Methods and Financial Reporting Analysis).

Topic weightings are important. They give candidates a clue of the section that carries the highest percentage. As such, candidates can increase their chances of passing their examinations by putting in a little more effort on topics that carry a lot of weight. Take, for example, a candidate who has gone through the whole curriculum and has less than a month to examination day. Such a candidate can choose to go over topics such as FRA one more time instead of a topic that carries a lower weight.

The 2022 topic weightings, which are similar to the 2020/2021 curriculum, are shown in the table below.

$$small{begin{array}{l|c} textbf{Level I Topic} & textbf{Level I Weight} \ hline text{Quantitative Methods} & 8-12% \ hline text{Economics} & 8-12% \ hline text{Financial Reporting and Analysis} & 13-17% \ hline text{Corporate Issuers} & 8-12% \ hline text{Equity} & 10-12% \ hline text{Fixed Income} & 10-12% \ hlinetext{Derivatives} & 5-8% \ hline text{Alternative Investments} & 5-8% \ hlinetext{Portfolio Management} & 5-8% \ hline text{Ethics} & 15-20%end{array}}$$

Spoiler alert!

Have you already noticed from the table above that corporate finance is no longer corporate finance but corporate issuers?

Have you also noticed that ethics is no longer the first topic?

Let us now look at the changes, topic-by-topic.

I. Quantitative Methods

The only constant reading in the 2022 edition is Reading 1 – The Time Value of Money reading. As will be discussed below, other readings have been deleted, added, and others updated.

Added Readings

Reading 2 – Organizing, Visualizing, and Describing data

Reading 7 – Introduction to Linear Regression (which used to be in the level II curriculum)

Deleted Readings

Reading 7 (of the 2020 curriculum) – Statistical Concepts and Market Returns.

Updated Readings

Four Quantitative Methods readings have been updated;

- Reading 3: Probability Concepts – the LOS “Calculate and interpret the 1) joint probability of two events, 2) the probability that at least one of two events will occur, given the probability of each and the joint probability of the two events, and 3) a joint probability of any number of independent events” has been scraped off the 2020 curriculum. The changes in other probability concept learning objectives are minor changes in wordings.

- Reading 4: Common probability distributions – Minor changes have been made to this reading. The LOS “describe properties of student’s t distribution and calculate and interpret its degrees of freedom” has been moved from reading 5, Sampling and estimation, to this reading. There has also been a change in the wordings of four learning objective statements.

- Reading 5: Sampling and estimation – The LOS “describe properties of student’s t distribution and calculate and interpret its degrees of freedom” has been moved to the “Common probability distributions” Reading. The LOS “describe the use of resampling (bootstrap, jackknife) to estimate the sampling distribution of a statistic” has been added.

- Reading 6: Hypothesis testing –- The LOS “explain tests of independence based on contingency table data” has been added. Several other learning objective statements have been updated. For instance, the LOS “explain a test statistic, type I and type II errors, a significance level, and how significance levels are used in hypothesis testing” has been updated to include the power of a test. It now reads, “explain a test statistic, type I and type II errors, a significance level, and how significance levels are used in hypothesis testing, and the power of a test.”

II. Economics

There has been no major content revision on this topic. Minor changes have been made to two readings.

Updated Readings

- The LOS “explain the IS and LM curves and how they combine to generate the aggregate demand curve” in reading 10: Aggregate output, prices, and economic growth has been updated. It now only talks about how the aggregate demand curve is generated.

- The LOS “describe credit cycles” has been introduced to reading 11: Understanding business cycles.

III. Financial Statement Analysis

Just like economics, no major changes have been made in this reading. Only one LOS in reading 24: Non-current (long-term) liabilities, has been revised.

IV. Corporate Issuers

Formerly known as corporate finance, the corporate issuer is now the fourth topic. Several changes have been made to this topic. Only one reading, reading 32:– Measures of leverage, has remained constant. A lot of readings have been introduced and a number removed.

Added Readings

- Reading 28 – Uses of Capital

- Reading 29 – Sources of Capital

- Reading 30 – Cost of Capital – Foundational Topics

- Reading 31 – Capital Structure

Deleted Readings

- Reading 32 (in the 2020 curriculum) – Capital budgeting

- Reading 33 (in the 2020 curriculum) – Cost of capital

- Reading 35 (in the 2020 curriculum) – Working capital management

Updated Readings

Only one reading, reading 27 – Introduction to corporate governance and other ESG considerations, has been updated to include ESG content.

V. Equities

Like economics and financial statements and analysis, no major content modification has been made in this topic. The only notable change is the split of the LOS “compare methods by which companies can be grouped, current industry classification systems, and classify a company, given a description of its activities and the classification system”, in the introduction to industry and company analysis, into two. The two LOSs are; compare methods by which companies can be grouped, describe current industry classification systems, and identify how a company should be classified, given a description of its activities and the classification system.

VI. Fixed Income

There are no new readings on this topic. It is noteworthy that no readings have been removed. However, several readings have been updated.

Updated Readings

- Reading 42 – Introduction to asset-backed securities: An LOS “describe characteristics and risks of covered bonds and how they differ from other asset-backed securities” has been added.

- Reading 43 – Understanding fixed income risk and return: An LOS “describe the difference between empirical duration and analytical duration” has been added.

- Reading 44 – Fundamentals of credit analysis: No major content-related change has been made in this reading. The only change that has been made in this reading is that two learning objective statements have been worded differently.

VII. Derivatives

No change has been made on this topic.

VIII. Alternative Investments

Alternative investments had only one reading in the previous curriculum. The current curriculum still has only one reading, reading 47: Introduction to Alternative Investments. However, major content revision has been done in the reading.

IX. Portfolio Management

One reading has been added, and two readings updated. No reading has been deleted.

Added Readings

- Reading 52 – The behavioral biases of individuals.

Updated Readings

- Reading 51: Basics of portfolio planning and construction – The content has been revised to include ESG consideration.

- Reading 54: Technical analysis – More examples have been added.

X. Ethics

Formerly the first topic in previous editions, Ethical and Professional Standards is now the last.

Added Reading

- Reading 60 – Ethics Applications

Deleted Reading

- Reading 5 – Global Investment and Performance Standards (GIPS).

Updated Reading

Reading 59 – Introduction to GIPS.

- Describe the key concepts of GIPS Standards for firms.

- Describe the fundamentals of compliance, including the recommendations of the GIPS standards concerning the definition of the firm and the firm’s definition of discretion.

- Describe the concept of independent verification.

Если вы хотите стать более востребованным на рынке труда, подтвердить свои знания в области финансов и инвестиций и получить документ, который ценится во всем мире, то вы можете сдать экзамен в CFA Institute.

В этой статье мы расскажем, что такое CFA сертификат, как устроен экзамен и как его сдавать в России в современных условиях.

Курс «Подготовка к CFA Level 1»

Подготовим к сдаче CFA (Level 1) — самого престижного и известного экзамена международного уровня в инвестиционной сфере!

Узнать подробнее о курсе

Chartered Financial Analyst (CFA) — это международный сертификат финансового аналитика от CFA Institute. Его можно получить после успешного прохождения 3х уровней экзамена.

CFA — это не обучающая программа. Это ассоциация аналитиков, которые помогают друг другу. Главные цели CFA — продвижение высоких стандартов этики в индустрии инвестиций и содействие профессиональному развитию через образование и помощь в карьере.

В первую очередь, этот экзамен актуален для:

- финансовых и инвестиционных аналитиков и консультантов;

- портфельных управляющих; по

- финансовых директоров;

- главных бухгалтеров и т.п.

Однако, если, например, юрист хочет сменить сферу деятельности, интересуется темой финансовых рынков и соответствует всем требованиям Института, то он также может зарегистрироваться и сдать экзамен.

В чем отличие степени CFA от похожих на него экзаменов

Существует несколько экзаменов, похожих на CFA областью проверки знаний и предназначением. Ниже мы разберем самые популярные тесты, которые сдают вместо CFA, и их отличия друг от друга.

CIMA (Chartered Institute of Management Accountants). Степень для финансистов и руководителей среднего и высшего звена. Развивает управленческие навыки на программе специального обучения.

MBA (Master of Business Administration). Наиболее известная степень для менеджеров, управленцев и финансистов. Престижность диплома определяется уровнем университета, на базе которого сдается MBA, его аккредитациями и преподавателями, задействованными в подготовке к сдаче экзамена. Для финансистов и банкиров существует направление MBA-финансы.

CPA (Certified Public Accountant). Квалификация для профессионалов из области финансового учета. Проверяет знания МСФО, МСА, налогообложения. Подходит для кандидатов, которые стремятся работать экономистами или финансистами в США.

ACCA (Association of Chartered Certified Accountants). Степень для специалистов налоговых процессов, финансистов, аудиторов и бухгалтеров с высокими компетенциями. В процессе подготовки к сдаче международного экзамена изучаются бизнес-английский, налогообложение, право, МСФО и финансовый учет.

CIPA (Certificate in International Professional Accounting) является международным сертификатом, предназначенным для бухгалтеров и налоговых консультантов. Он отличается от других экзаменов тем, что сдается на русском языке и основным образом котируется только в СНГ.

Как устроен экзамен на получение CFA сертификата

На сайте CFA Institute можно найти 2 основных критерия допуска к экзамену и получения сертификата:

- Образование (в любой сфере):

— во время регистрации на первый уровень экзамена вы учитесь на последнем курсе бакалавриата любого направления;

— у вас есть диплом бакалавра;

- Наличие действительного загранпаспорта.

Экзамен проводят в очном формате на английском языке. Участник проходит тестирование на компьютере в специальных центрах института. С собой можно брать воду, снеки и калькуляторы определенных моделей. Карандаши и бумагу для личных записей Институт предоставляет сам.

Для регистрации на экзамен необходимо внести несколько платежей:

- Регистрационный взнос — претендент платит его один раз, даже если ему придется пересдавать, например, 10 раз. С февраля 2023 года регистрационных взнос стоит — $350.

- Early Registration ($900) и Regular Registration ($1200) — они вносятся при регистрации на каждом уровне. Если вы успели зарегистрироваться заранее, то нужно будет заплатить $900. Если позже, то — $1200.

Экзамен состоит из 3 уровней. Первые два включают в себя больше заданий и кейсов с вариантами ответов, а на 3-ем нужно больше анализировать и давать полные обоснованные ответы. Все вопросы можно разделить на 4 основных направления:

- этика и профессиональные стандарты;

- технические навыки и инвестиционные инструменты;

- типы активов, как с ними работать;

- как формировать портфель, соотношение рисков, финансовое планирование.

CFA Институт не занимается подготовкой к экзаменам. Претенденты на сертификат самостоятельно находят подготовительные курсы и программы и проходят обучение. Например, вы можете пройти наш курс — «Подготовка к CFA Level 1«.

В среднем по миру на подготовку к экзамену уходит 3-4 года. Претенденты часто отдают всё свое свободное время на заучивание сложных формул и решению тестовых заданий. Однако по словам специалистов, сдававших CFA, простой “зубрежкой” по материалам из открытого доступа сдать экзамен практически невозможно.

Чтобы помочь вам успешно пройти тесты CFA и стать сертифицированным международным финансистом, в программу программу “CFA Level 1” включили интенсивные занятия в группе, состоящей всего из 30 человек, по каждой теме, которая будет освещаться на экзамене. На курсе за 4 месяца Вы несколько раз пройдете пробные тесты и сможете задать свои вопросы экспертам курса. Каждое занятие записывается — просмотреть видео-уроки вы сможете из любой точки мира.

За это время вы успеете получить всю необходимую информацию и полезные лайфхаки для успешного прохождения экзамена. Если не получится сдать с первого раза, вы можете пройти наш курс бесплатно еще раз. Также вы получить безлимитный вечный доступ ко всем материалам.

Курс «Подготовка к CFA Level 1»

Подготовим к сдаче CFA (Level 1) — самого престижного и известного экзамена международного уровня в инвестиционной сфере!

Узнать подробнее о курсе

Как сдать экзамен в 2023 году, если вы из России

Зарегистрироваться на экзамен можно только через сайт CFA Institute, который сейчас работает в нашей стране только через VPN. Поэтому кандидаты из России не могут подавать заявку и оплачивать экзамен российскими рублями.

Однако ограничения распространяются только на место проживания, а не на гражданство. Это значит, что вы можете сдать экзамен в любой другой стране на ваш выбор.

В мире есть примерно 400 учебных центров CFA Institute. Из ближайших стран, до которых летают прямые рейсы из Москвы, можно выбрать:

- Казахстан — Астана;

- Армения — Ереван;

- Азербайджан — Баку;

- Турция — Стамбул, Анкара, Измир;

- ОАЭ — Дубай и др.

Поэтому, если у вас есть желание получить CFA сертификат, вы можете зарегистрироваться на экзамен через другую страну. CFA Institute идет навстречу и позволяет кандидатам, которые уже внесли взносы, заново пройти регистрацию без потери средств.

Вместе с нашим курсом по подготовке к экзамену CFA, вы получите доступ к крупнейшему сообществу специалистов в сфере финансов. При наличии вопросов или проблем с подготовкой, вы сможете в любое время написать в telegram чат-нетворк и получить ответы практически 24/7

CFA exam / Calendar

In the 2023 CFA exam calendar, there are 4 level 1 CFA exam windows:

- 1st CFA exam window: 14-20 FEB 2023

- 2nd CFA exam window: 16-22 MAY 2023

- 3rd CFA exam window: 22-28 AUG 2023

- 4th CFA exam window: 11-17 NOV 2023

After you register for one of the exam windows, you’ll need to self-schedule your CFA exam date. Don’t worry – you can change your CFA exam date if needed. However, to register for the CFA exam and then schedule or reschedule your CFA exam, you need to stick to some deadlines.

Create Personalized Study Plan

Create Study Plan

Yep, CFA exam calendar is full of deadlines and important dates. Here you can find key level 1 dates & deadlines for currently available level 1 exams.

Key Dates in Your Level 1 CFA Exam Calendar

Key level 1 CFA exam dates surely include the start and end dates of CFA exam:

- registration window,

- scheduling window,

- rescheduling window.

2023 LEVEL 1 CBT CFA EXAM WINDOWS

| Level 1 CFA Exam Window | Registration Window | Scheduling Window | Rescheduling Window |

|---|---|---|---|

| 14-20 February 2023 | 10 May — 8 Nov | 10 May — 16 Nov | 10 May — 13 Jan |

| 16-22 May 2023 | 9 Aug — 31 Jan | 9 Aug — 15 Feb | 9 Aug — 14 Apr |

| 22-28 August 2023 | 14 Nov — 9 May | 14 Nov — 24 May | 14 Nov — 21 July |

| 11-17 November 2023 | 31 Jan — 8 Aug | 31 Jan — 16 Aug | 31 Jan — 13 Oct |

Learn more about CBT CFA exams

See Level 2 & Level 3 CFA exam dates

Save CFA Exam Date in Your Calendar!

STEP 1: REGISTER

CFA Exam Registration Window is the period when the CFA exam registration for your exam is open. You will register for your CFA exam as soon as you make the registration fee payment of USD 900 (early birds) or USD 1200 (standard) + a one-time enrollment fee of USD 350 upon your first level 1 CFA exam registration.

HOW to REGISTER for CFA EXAM? Go to the CFA Institute website, sign up and in your account choose one of the available exam windows. You’ll be asked to submit your registration form and make the payment.

Register by the registration deadline!

STEP 2: SCHEDULE (obligatory)

CFA Exam Scheduling is the period when YOU MUST SELF-SCHEDULE YOUR CFA EXAM by choosing the exact date in your CFA exam window and booking it in ProScheduler (scheduling tool). Scheduling is free of charge and obligatory if you don’t want to lose your registration fee. You won’t be able to sit your CFA exam unless you self-schedule your exam date before the deadline!

HOW to SELF-SCHEDULE your CFA EXAM? Use ProScheduler, which is a dedicated platform where you can schedule your CFA exam. When scheduling your exam, search by country and city to book your exam day. Best look up the whole exam window and then choose the exact day and time of your CFA exam according to your preference. Scheduling should be available to you in your CFA Institute account as soon as your registration payment is processed (you’ll be redirected to ProScheduler). Note that you are not successfully scheduled for your exam unless you receive an e-mail confirmation of the appointment.

Schedule your CFA exam by the scheduling deadline!

STEP 3: RESCHEDULE (optional)

CFA Exam Rescheduling is the period when you can change your CFA exam date within your exam window by paying a fee of USD 250 per each(!) exam re-appointment. This is useful if for some reason you want to take your CFA exam in your exam window but need to change your chosen exam date, time or location or if your scheduled exam date is your second best choice but you’d rather take your exam some other day, time or place within your registered exam window.

HOW to RE-SCHEDULE your CFA EXAM? This option is available to you in your CFA Institute account, Candidate Tile. Note that it’s available only for your chosen exam window! You cannot reschedule your CFA exam from one window to another. For this, you may consider paid deferral (see below).

Reschedule your CFA exam by the reschedule deadline!

Create Personalized Study Plan

Create Study Plan

Other Dates in CFA Calendar Worth Interest

There are also some other dates that you may find important such as:

- early registration deadline, by which your registration cost is lower by USD 300 (early registration fee is USD 900 instead of USD 1200)

- pay-by-invoice deadline, which may be particularly of interest to candidates from India who can now get a low-interest loan to register for their CFA exam

- scholarship deadlines (CFA exam scholarships reduce your exam cost substantially)

- CFA exam emergency deferral deadline, which is up to 3 days following the close of the exam window to be used in case of some emergencies that you can document (e.g., life-threatening illness or death of an immediate family member, grandparents excluded)

- CFA exam paid deferral, which is available approx. a month before the exam window to be purchased at USD 399 until up to 24 hours before your scheduled exam appointment. Once you submit your CFA exam deferral, your exam appointment will get canceled! If you don’t have a scheduled appointment, the paid deferral deadline is up to 3 days following the close of the exam window. Paid deferral is available once per paid exam registration. It gives you a right to postpone your exam appointment for up to 12 months according to new registration & scheduling deadlines.

Can I Change My CFA Exam Date?

Yes, you can change your CFA exam date. There are a few ways to do it depending on your situation.

So, the ways to change your CFA exam date include:

- exam rescheduling: available only for the exam window you registered for; rescheduling fee is USD 250 every time you wish to reschedule;

- emergency deferral: when you want to move your CFA exam to a new exam window and can document that you haven’t been able to take your scheduled exam, it’s free but needs to be well documented or else it won’t be granted;

- paid deferral: available only once per paid registration, you need to pay an extra fee of USD 399 to be able to change your exam date to a new exam window, no questions asked but once you submit your deferral – the decision’s final and your scheduled exam gets canceled;

- COVID deferral: deferral at no additional cost in case your scheduled exam gets canceled due to COVID restrictions.

2023 Level 1 CFA Exam Deadlines Timetabled

| MAY 2023 Deadlines | AUG 2023 Deadlines | NOV 2023 Deadlines |

|---|---|---|

|

|

|

Note that CFA Institute reserves the right to prematurely close registration and scheduling dates.

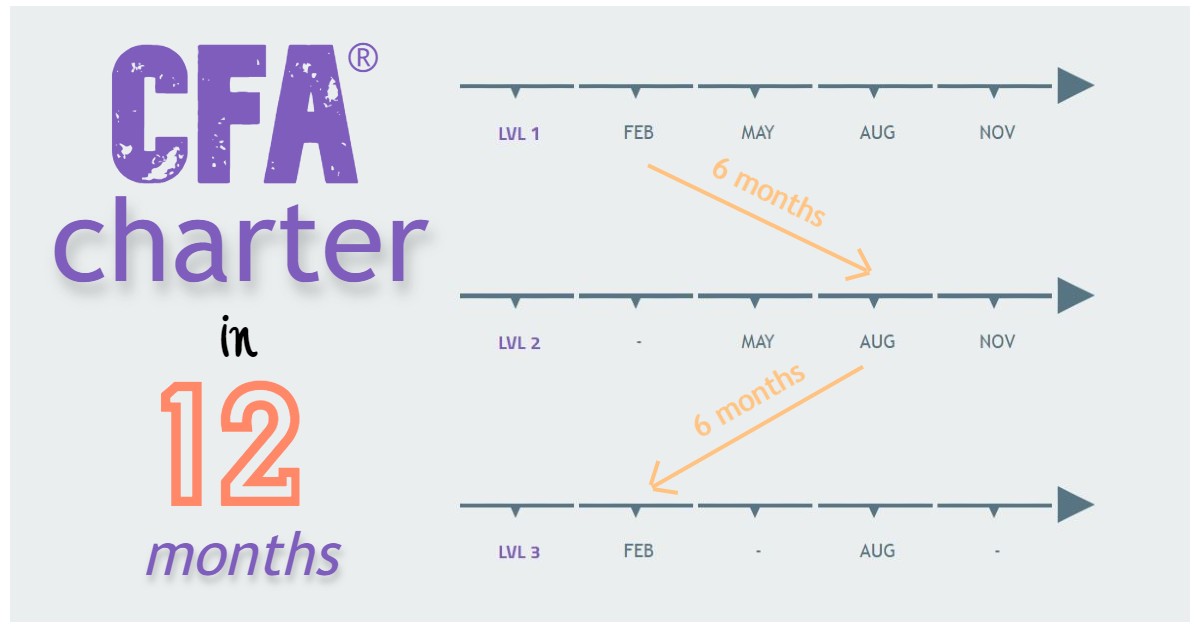

Can I Pass CFA Exam In 12 Months?

Yes, you can pass your CFA exam, all 3 levels, within a year, i.e., in 12 months!

12 months is the quickest path to get your CFA charter but you need to strictly follow the CFA exam schedule, where you take your level 1 CFA exam in FEB, then level 2 – in AUG, and finally level 3 – in FEB of the next year. This makes 12 months from your level 1 to your level 3 CFA exam sitting. Of course, the assumption is that you pass all levels at the first attempt and the part when you wait for your final CFA exam result to be released is no longer counted in.

Other scenarios are a bit longer than 12 months. Actually, with the CBT CFA exams in place, you can now get your CFA charter in 12 to 18 months.

Based on the current CFA exam calendar for CBT exams, there are 3 level 2 CFA exam windows per year available to CFA candidates in May, Aug, and Nov. As far as the level 3 CFA exam goes, there are 2 level 3 CFA exam windows per year in February and August. How fast you can get your CFA charter depends on what path you’ll choose for yourself + how many retakes or exam deferrals you’ll need.

Published: Aug 22, 2020

Read Also:

- All About Level 1 CFA Exam

- Level 1 CFA Exam Structure

- CFA Exam Curriculum

- Study Guide for Level 1 CFA Candidates

- How to Create Study Plan