CFA Exam Results Released

The soonest you can expect your FEB 2023 level 1 CFA exam results is on 28 March* 2023, i.e. 5 weeks post-exam. Most probably, FEB level 3 CFA candidates may expect their exam results on 18 Apr*. Generally, CFA Institute has even up to 60 days to release level 1 CFA exam results and 90 days to announce level 3 results.

So far, the usual pattern for releasing CBT results has been: CFA exam date + 6-7 weeks for level 1 / 7-8 weeks for level 2 / 8-9 weeks for level 3. AUG 2022 level 1 & level 2 CFA exam results were the first CBT results to be made available roughly 5 weeks post-exam. We think it’s possible that level 1 FEB candidates won’t have to wait 6 or 7 weeks for their results. As far as level 3 candidates are concerned, CFA Institute is trying to speed up the release of results but level 3 is always more time consuming due to essay questions.

CFA exam results have usually been released either on Tuesday or on Thursday.

| Your CFA Exam | Exam Date | Expected CFA Exam Results Date |

Pass Rate |

|---|---|---|---|

| FEB 2023 Level 1 Exam | 14-20 Feb 2023 | 28 March* 2023 | still waiting |

| FEB 2023 Level 3 Exam | 21-23 Feb 2023 | 18 Apr* 2023 | still waiting |

| Nov 2022 Level 1 Exam | 15-21 Nov 2022 | 12 Jan 2023 | 36% |

| Nov 2022 Level 2 Exam | 22-26 Nov 2022 | 19 Jan 2023 | 44% |

| Aug 2022 Level 1 Exam | 23-29 Aug 2022 | 4 Oct 2022 | 37% |

| Aug 2022 Level 2 Exam | 30 Aug-3 Sept 2022 | 11 Oct 2022 | 40% |

| Aug 2022 Level 3 Exam | 30 Aug-6 Sept 2022 | 1 Nov 2022 | 48% |

| May 2022 Level 1 Exam | 17-23 May 2022 | 7 July 2022 | 38% |

| May 2022 Level 3 Exam | 24-26 May 2022 | 28 July 2022 | 49% |

| Feb 2022 Level 1 Exam | 15-21 Feb 2022 | 12 Apr 2022 | 36% |

| Feb 2022 Level 2 Exam | 22-26 Feb 2022 | 19 Apr 2022 | 44% |

| Nov 2021 Level 1 Exam | 16-22 Nov 2021 | 11 Jan 2022 | 27% low pass rate? |

| Nov 2021 Level 2 Exam | 26-30 Nov 2021 | 19 Jan 2022 | 46% |

| Nov 2021 Level 3 Exam | 23-25 Nov 2021 | 3 Feb 2022 | 43% |

| Aug 2021 Level 1 Exam | 13-30 Aug 2021 | 14 Oct 2021 | 26% |

| Aug 2021 Level 2 Exam | 31 Aug — 4 Sept 2021 | 21 Oct 2021 | 29% |

| Aug 2021 Level 3 Exam | 1-8 Sept 2021 | 2 Nov 2021 | 39% |

| July 2021 Level 1 Exam | 18-26 July 2021 | 14 Sept 2021 | 22% |

| May 2021 Level 1 Exam | 18-24 May 2021 | 27 July 2021 | 25% |

| May 2021 Level 2 Exam | 25 May — 1 June 2021 | 3 Aug 2021 | 40% |

| May 2021 Level 3 Exam | 25 May — 1 June 2021 | 10 Aug 2021 | 42% |

| Feb 2021 Level 1 Exam | 16 Feb-1 March 2021 | 13 April 2021 | 44% |

| Dec 2020 Level 1 Exam | 5/6 December 2020 | 28 January 2021 | 49% |

| Dec 2020 Level 2 Exam | 5/6 December 2020 | 28 January 2021 | 55% |

| Dec 2020 Level 3 Exam | 5/6 December 2020 | 17 February 2021 | 56% |

| Dec 2019 Level 1 Exam | 7 December 2019 | 30 January 2020 | 42% |

* This is our educated & most optimistic guess (but the results may arrive even later…).

As soon as you receive your CFA exam results, you can register to your next exam (next level or retake). However, the choice is yours. You can take as much time as you need before you actually register for your next exam.

NOTE!

2023 study plans (all levels) are available:

create a free CFA study plan here

You’ll get your results to your e-mail.

The e-mail message will tell you whether you PASSED or DID NOT PASS. Also, for your level 1 and level 2 exam you will learn about your performance for given topics relative to other exam takers (go to your CFA Institute account for more details). This information can help you in your preparation for future exams.

In this post, you can also

learn about:

- CFA Exam Passing Score: What is the MPS?

- When and How is the MPS Set?

- *Grading Cases* |OUR EXAMPLES|

- What’s the CFA Exam Results Format?

- How High Are CFA Exam Pass Rates?

- What to Do if You FAIL Your CFA Exam?

- What to Do if You PASS Your CFA Exam?

CFA Exam Passing Score:

What is the MPS?

To pass your CFA exam, you have to meet the minimum passing score (MPS) set individually for each ended exam. The MPS may vary across years but it probably never exceeds 70%. However, neither the MPS nor individual candidate score are ever released.

So, you will never know precisely how many points you scored or what percentage level you reached. All you can say is that:

if you PASSED you met the MPS or you were close enough for the ethics adjustment to pull you through,

if you FAILED you were below the MPS or the ethics adjustment worked to your disadvantage.

To maintain high grading standards, the MPS will be set as always also for computer-based CFA exams.

When and How is the MPS Set?

The exact MPS value is set by the CFA Institute Board of Governors who gather after the exam to establish it. The set MPS value falls within the valid range established using the modified Angoff method, which provides an empirical basis for the MPS settlement. Applying the method, a large and diverse group of CFA charterholders assesses both the exam difficulty and actual candidate performance before the MPS is finally determined.

So Much Info and You Still Feel Like You Know Nothing?

You’re right. CFA Institute is very secretive about our results and hardly any hard facts can be given to narrow the information gap. Let us, however, wrestle a bit and try to draw some conclusions from what we know.

First, we need to set some common ground.

Let’s take the level 1 CFA exam, for example. There are 2 exam sessions, each including 90 exam questions. That makes it 180 questions for the whole level 1 exam. If we assume every question is worth 1 point, we end up with the maximum total score of 180 points. For an incorrect answer, no points are deducted.

Keeping in mind the common ground assumptions and facts about CFA exam results we gave above, we are able to analyze some grading-related issues and dispel some popular myths:

Question 1: Is the minimum passing score above 70%?

Question 2: Do I have to pass all the topics, to pass my CFA exam?

Question 3: Can I do badly in Ethics? There’s Ethics adjustment!

Question 4: Does topic performance objectively indicate which topics definitely need improvement and which are fine?

Question 1: Is the minimum passing score above 70%?

Question 2: Do I have to pass all the topics, to pass my CFA exam?

Question 3: Can I do badly in Ethics? There’s Ethics adjustment!

Question 4: Does topic performance objectively indicate which topics definitely need improvement and which are fine?

Q-1: Is the minimum passing score above 70%?

Forget about it!

Actually, the MPS for CFA exams is most likely to be slightly below 70%. To prove this observation, let’s examine the following situation:

Assume the MPS of 75%. You are notified about your level 1 CFA exam result. In the topic performance information, you see you scored above 70% for every topic. Still, your exam score message says you FAILED. You feel confused: “How come I failed? All my topic scores are above the 70% threshold which according to CFA Institute is a reasonable signal of topic mastery”.

That is why it is impossible for the MPS to exceed 70%. Otherwise, you could always end up confused about your exam results like in our example.

Why?

To make the situation described above more clear-cut, let’s analyze it bit by bit.

From your topic performance information, you know you scored above 70% for each topic. So, your total score must have been above 70%. But since you know you failed, it must have been lower than the MPS (below 75% for our example). Perhaps you achieved 72% for each topic. You didn’t reach the MPS and that’s why you failed.

Even if our example is just a simplification, it shows well that for the MPS values above 70% there’s practically always a gap for those who may fail their exam despite having all their topic scores in the mastery range. Quite an undesirable situation for the candidates whose exam performance is on the verge of mastery, don’t you think?

CONCLUSION:

If the MPS is above 70%, the grading system fails to be transparent. Thus, it’s most probable that usually the MPS fluctuates between 65% and 70%. However, for 2021 level 1 CFA exams, the MPS most probably exceeded 70%, which led to exceptionally low level 1 CFA exam pass rates :/

Q-2: Do I have to pass all the topics, to pass my CFA exam?

Wait, but what does it actually mean to pass a topic? To score over 70%? Or to be above the MPS for the topic?

What you need to do to pass your CFA exam is to meet or exceed the MPS. But it holds true for your total exam score, not for separate topics. That’s a major principle!

Of course, if you score over 70% for every topic, it should ensure your passing the exam (see Question no. 1 above).

However, consider the following example:

You receive your level 1 CFA exam results. You did poorly in 2 topics and moderately fine in 5 (this time, we assumed the MPS of 69%):

| LEVEL 1 TOPIC | Score (%) | Score (pts) | No. of Questions |

|---|---|---|---|

| Ethical and Professional Standards | 89% | 25 | 28 |

| Quantitative Methods | 94% | 17 | 18 |

| Economics | 67% | 12 | 18 |

| Financial Statement Analysis | 69% | 18 | 26 |

| Corporate Issuers | 69% | 11 | 16 |

| Portfolio Management | 86% | 12 | 14 |

| Equity Investments | 65% | 13 | 20 |

| Fixed Income | 45% | 9 | 20 |

| Derivatives | 40% | 4 | 10 |

| Alternative Investments | 60% | 6 | 10 |

| Your Total Score (SUM) | 70% | 127 | 180 |

| MPS* | 69% | 124.2 | — |

* This is our assumption. CFA Institute never gives you exact scores or releases the MPS.

Does it mean the e-mail message says you FAILED?

No! The example illustrates how various scores for different topics still give you a PASS because you managed to meet the MPS of 69% set for your exam.

CONCLUSION:

Your total exam score is what counts! As a rule, to pass you must meet or exceed the minimum passing score set for your exam. The math is merciless, however. If you do badly for any of the topics, you have to excel at some other. In other words, every topic scored below the MPS has to be offset by another topic scored way above the MPS. This way, your total score can meet the MPS criterion and you pass.

Q-3: Can I do badly in Ethics? There’s Ethics adjustment!

We’ve just said that the major principle behind passing the exam is meeting or exceeding the MPS.

So, even if you do badly on the Ethics questions but do great overall, you’ll pass your exam. Take a look at our example:

| LEVEL 1 TOPIC | Score (%) | Score (pts) | No. of Questions |

|---|---|---|---|

| Ethical and Professional Standards | 32% | 9 | 28 |

| Quantitative Methods | 83% | 15 | 18 |

| Economics | 83% | 15 | 18 |

| Financial Statement Analysis | 88% | 23 | 26 |

| Corporate Issuers | 88% | 14 | 16 |

| Portfolio Management | 64% | 9 | 14 |

| Equity Investments | 80% | 16 | 20 |

| Fixed Income | 75% | 15 | 20 |

| Derivatives | 80% | 8 | 10 |

| Alternative Investments | 90% | 9 | 10 |

| Your Total Score (SUM) | 74% | 133 | 180 |

| MPS* | 67% | 120.6 | — |

* This is our assumption. CFA Institute never gives you exact scores or releases the MPS.

For the level 1 CFA exam, the number of questions per topic may vary from exam to exam. That’s because CFA exam topic weights are given in ranges.

We assume there’ll be as many as 28 Ethics questions in your exam. You must have gotten only 9 questions right because you scored only 32% in Ethics. But wait a minute. Other scores are great! It’s impossible you failed your exam. Your total score exceeds 70% by far, so it also exceeds the MPS of 67% that we assumed for your exam.

Be careful, though.

You may not manage to exceed the MPS much enough. If your final score just borders the MPS, poor performance in Ethics will definitely contribute to your failure in the exam. That’s because of the Ethics adjustment explained in our post: Why Your Ethics Score Matters.

CONCLUSION:

You do not have to excel at Ethics to pass your exam. However, here are 3 reasons for which it is surely worth paying attention to Ethics:

1. The significance of ethical conduct at a workplace is unquestionable. The better you know the CFA Institute Code of Ethics and Standards of Professional Conduct, the more sensitive you’ll be to possible violations and better equipped to handle various situations.

2. You will be tested on Ethics at every level of your CFA exam and every time Ethics will be counted among the most important topics.

3. Ethics adjustment is applied to borderline cases. A good grade for the Ethics questions may pull you through if your total exam score borders the MPS. But if your Ethics performance is weak, it may cause you to fail the exam.

Study Ethics

Get Study Plan

Study Ethics:

Get Study Plan

Q-4: Does topic performance objectively indicate which topics definitely need improvement and which are fine?

It’s not all that easy.

The information about your performance in different topics is meant to identify your strengths and weaknesses. However, there’s no objective truth about it. To prove the point, we analyze two opposing situations:

SITUATION no. 1:

You scored poorly for Alternative Investments (AI). Before the exam, you felt quite strong on the topic. What to trust? The numbers or your intuition?

We assumed in the tables above that your level 1 exam included only about 10 AI questions, while the topic runs for about 100 pages in the CFA Program Curriculum. So, the AI exam sample was quite small relative to the overall material on the topic. Notice that if you answered correctly just one more question, your AI score would be higher by as much as 10 percentage points. That would shift you up quite a bit!

So, is AI definitely your weak point or was it just bad luck?

Before we can answer this question, we need to consider another example:

SITUATION no. 2:

You scored poorly for Financial Statement Analysis (FSA). Weakness or misfortune?

This time the exam sample is bigger. The topic is quite extensive and your test was expected to contain as many as 26 FSA questions. Every correct answer improved your topic score by roughly 3.8 percentage points.

* Note that Alternative Investments, Derivatives, and Portfolio Management all are given the same exam weight of 5-8%. We assumed here that AI was a topic with the fewer questions. Nevertheless, you should be aware that in your real exam questions may be distributed a bit differently among topics. Read here about level 1 topic weights and questions.

CONCLUSION:

For some topics, there are too few questions on the exam to definitely categorize them as your weakness or strength. In such cases, it may be hard to decide whether you know the topic poorly indeed or if it was just bad luck (or good luck for that matter because although you scored over 70%, you feel you still don’t know much about the topic). For topics with a bigger number of questions, exam results are more representative. It is more likely that they really indicate whether you need to improve the topic or if you managed to master it already.

You have to stay rational about it. To resolve doubtful situations in which your exam performance contrasts your intuition about a topic, an additional parameter may come in handy. Your mock exam scores can serve as good indicators. If you usually scored rather low for AI, and now your AI exam score is also poor, you definitely need to improve this topic area. If, however, you scored high in all the mock exams you took, the low exam result for AI may just be an accident. Still, it can’t harm you if you study even harder before your next exam.

Master Topics

Get Study Plan

Master Topics:

Get Study Plan

What’s the CFA Exam Results Format?

Here are the 2 most important things when you view your CFA exam results:

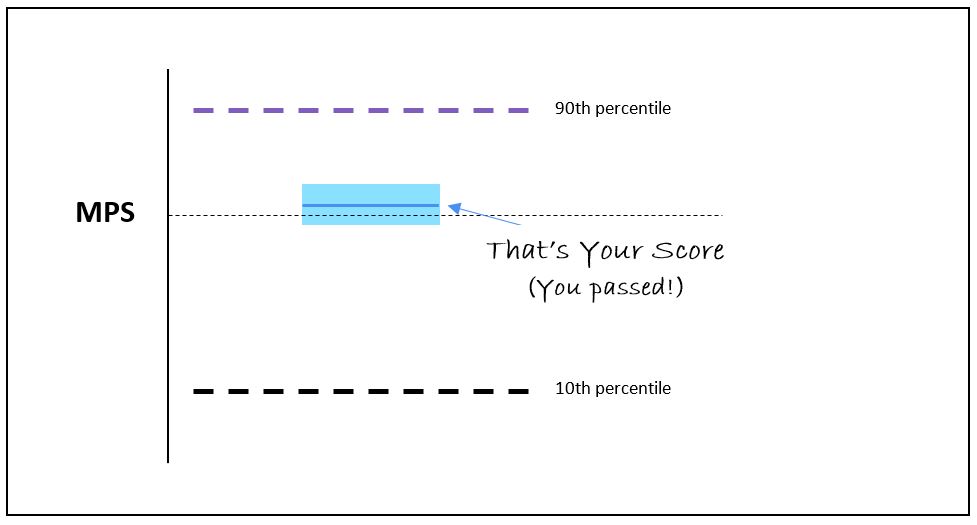

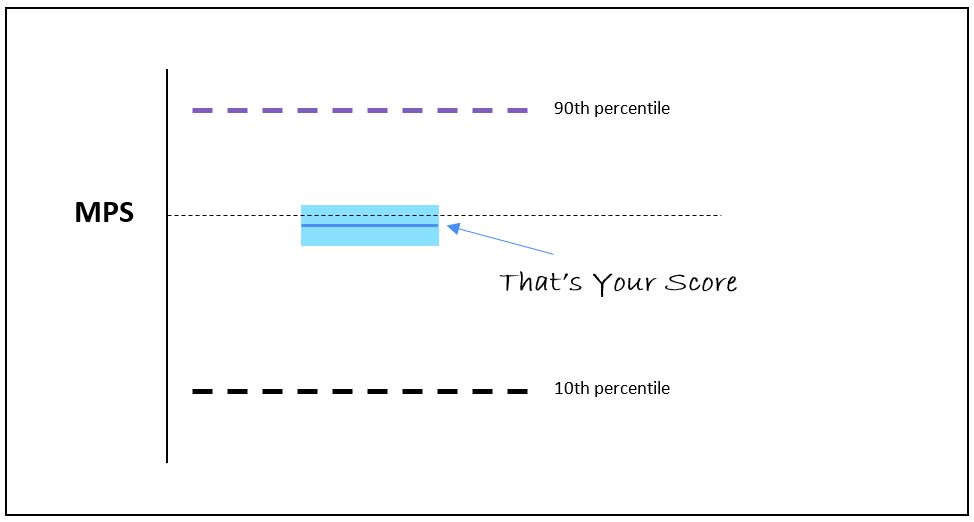

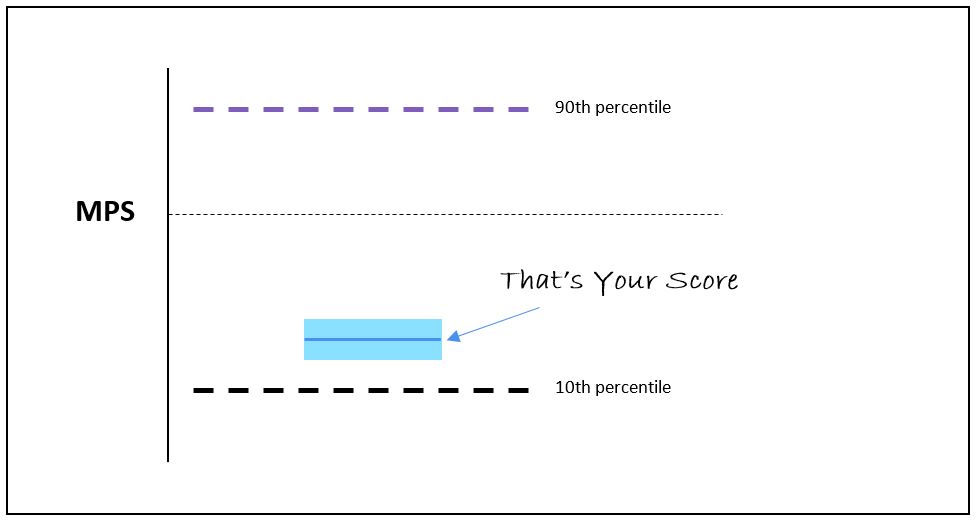

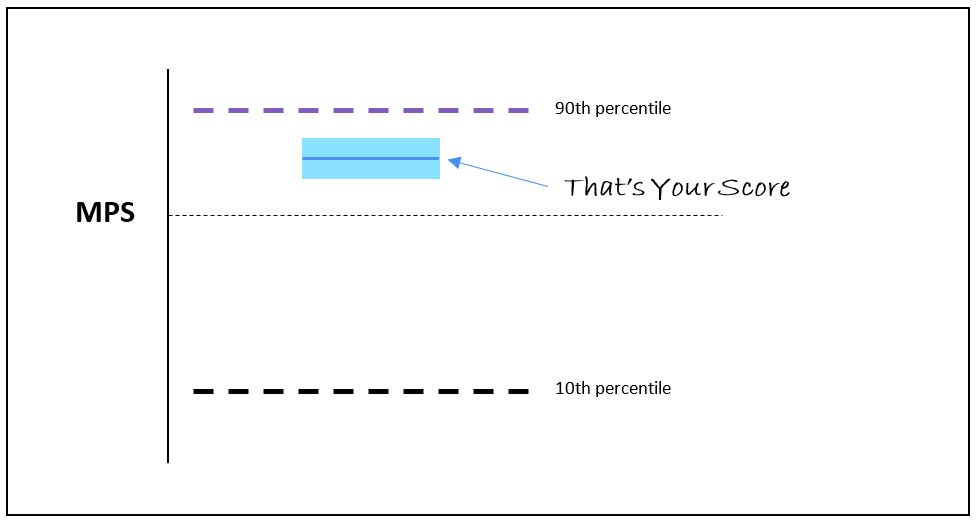

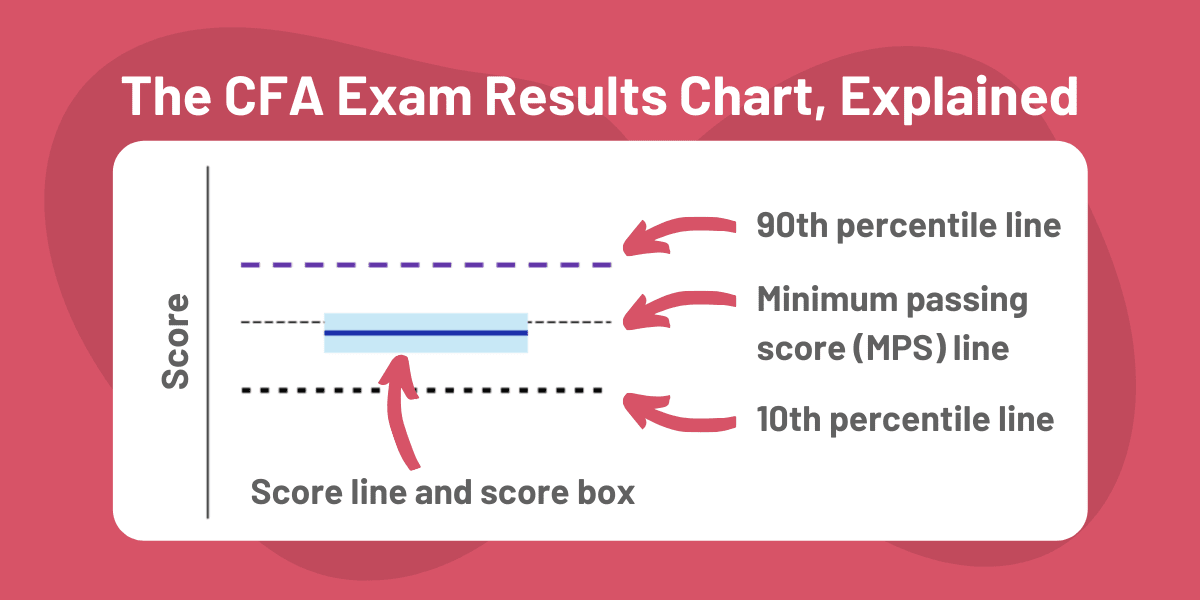

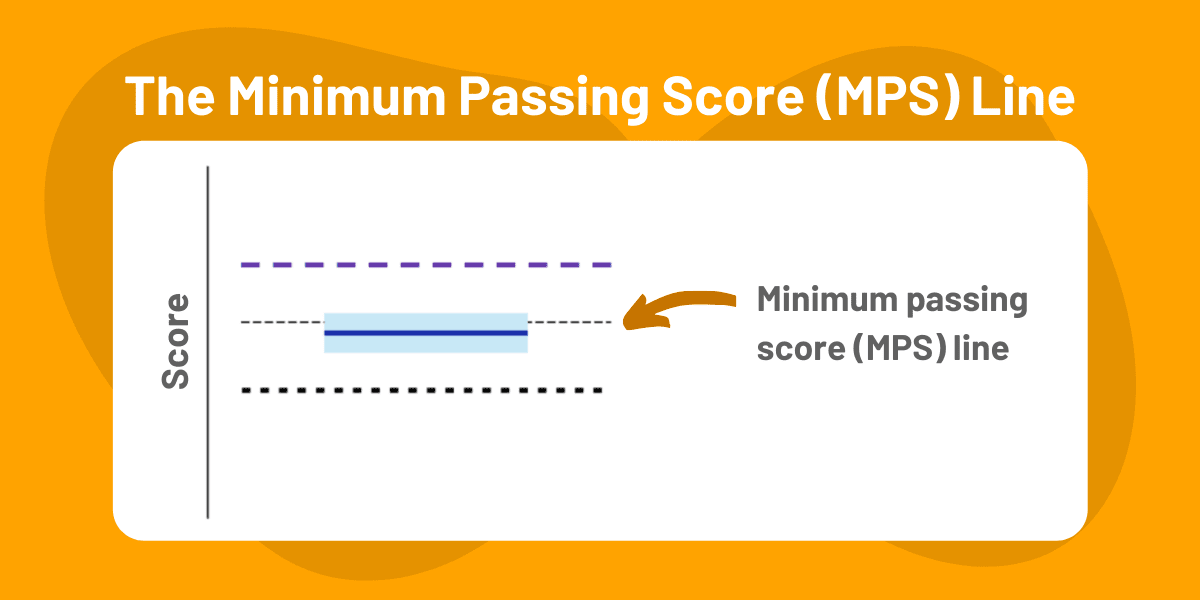

thin dashed black line & thick blue line

The thin dashed black line is the MPS set for your exam. The thick blue line is YOU.

When it comes to your exam score:

- blue ABOVE black = you PASSED

- blue BELOW black = you FAILED

In Jan 2018, CFA Institute introduced this new – more visual – way of informing CFA exam takers about their scores.

More visual means more attractive. However, it still lacks the transparency and concreteness candidates long for.

In line with what we’ve already said, no concrete value is attributed to neither the blue (YOU) nor the black (MPS) line. Moreover, if your score is close enough to MPS, your blue line may even overlap with the black MPS line, which – unfortunately – will not always mean you passed :/.

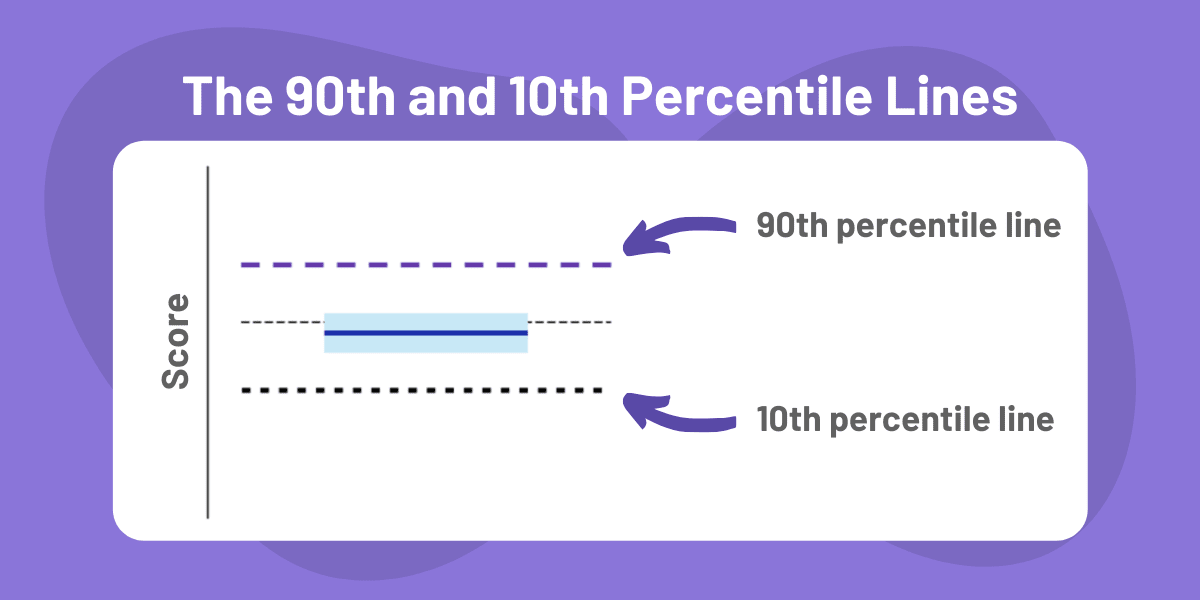

For the sake of visual presentation, you’ll also see:

- a thick purple dashed line telling you that only 10% of all candidates scored higher than that, and

- a thick black dashed line telling you that only 10% of all candidates scored lower than that.

Both these lines will be placed – respectively – above and below the thin dashed black MPS line. They are to show you how you did in the exam compared to others. (We hope you can always find your thick blue line in the close vicinity of the purple line and way above the MPS line!)

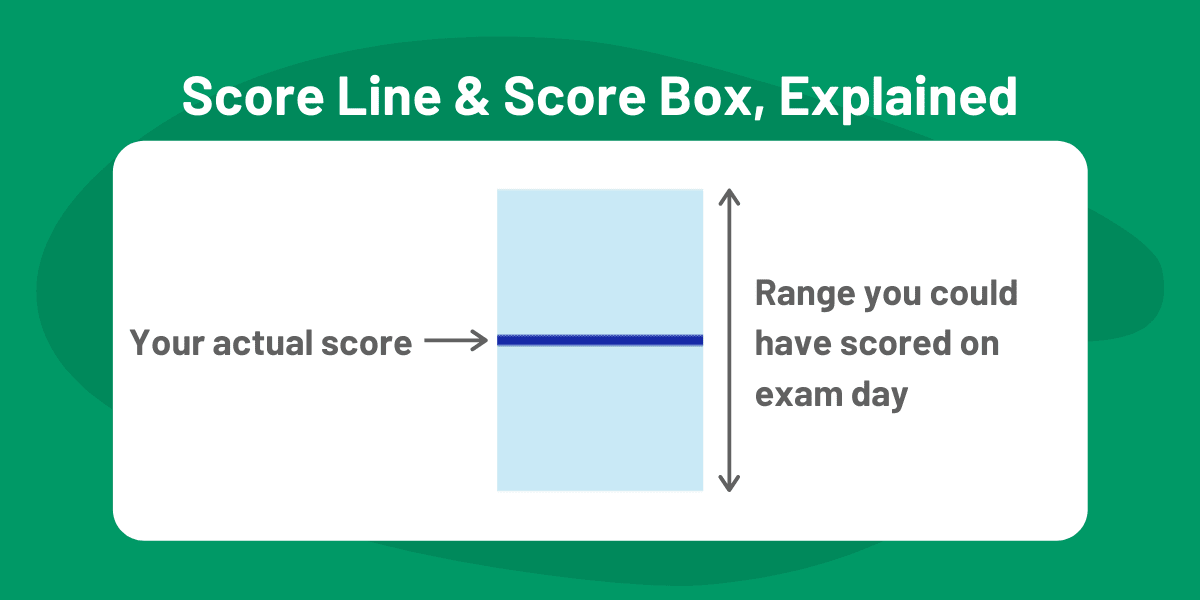

Last but not least, because different favorable & unfavorable factors may influence your exam score – you will find your thick blue line inside a light blue box (confidence interval). This is to show your true ability, which might be higher than the line (but on the exam day you had to face some unfavorable circumstances) or lower than the line (but in the exam you worked under favorable circumstances). The fact that CFA Institute is trying to allow for additional factors is actually good!

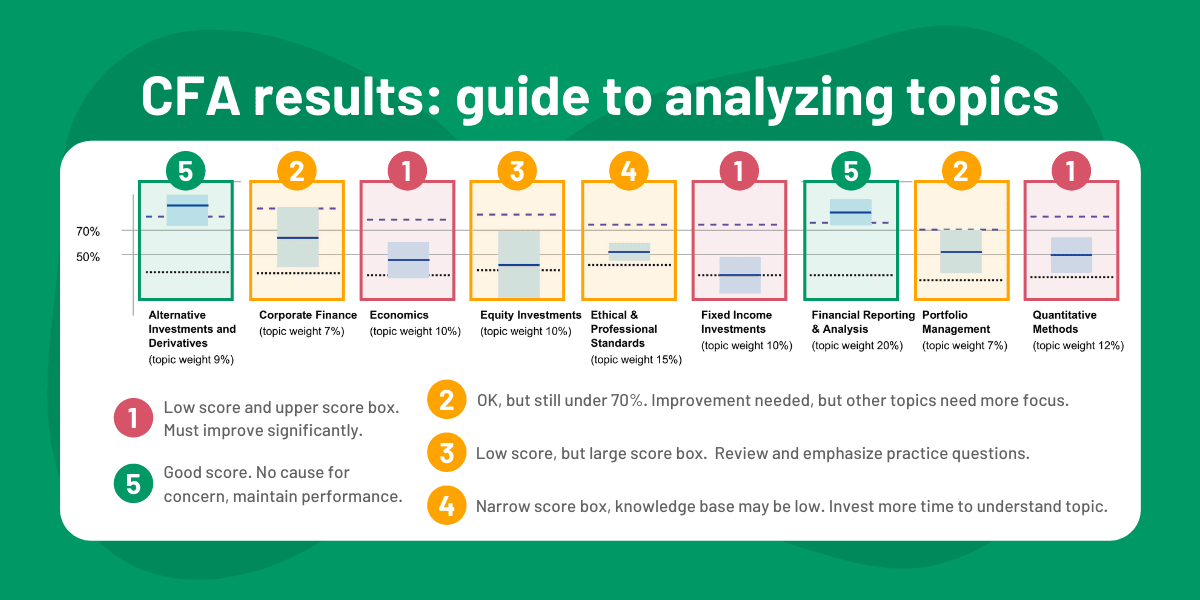

For your topic performance presentation, the rules applied are pretty much the same. You’ll get an estimation of:

- your topic score in the exam (blue line – no exact value given again),

- your true topic ability (blue confidence interval – allowing for different favorable & unfavorable factors),

- your topic performance compared to other candidates (thick dashed purple and black lines – indicating 10% of the best vs worst topic scores).

These estimations are all set against the MPS-like 70%-value thin black line which is considered to indicate ‘topic mastery’. Your topics performance is generally presented using separate blue lines.

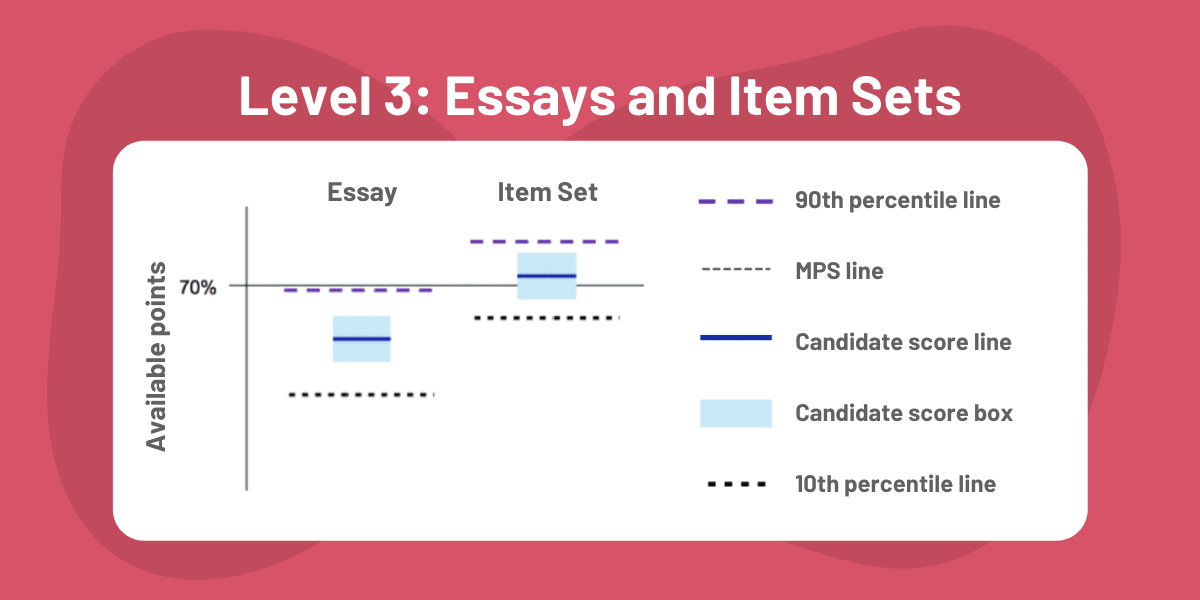

Level 3 candidates will also find a similarly presented ‘essays vs item sets’ comparison showing their performance in the exam.

How High Are CFA Exam

Pass Rates?

In previous years, CFA exam pass rates were fairly fixed around 43% for level 1, 46% for level 2, and a bit over 50% for level 3. In 2021, level 1 CFA exam pass rates were astonishingly low. However, the 2022 level 1 pass rates are higher, which is hopefully a good sign.

| Year | Level 1 CFA Exam Pass Rates | Level 2 | Level 3 |

|---|---|---|---|

| 2015 | 42% (June); 43% (Dec) |

46% (June) | 53% (June) |

| 2016 | 43% (June); 43% (Dec) |

46% (June) | 54% (June) |

| 2017 | 43% (June); 43% (Dec) |

47% (June) | 54% (June) |

| 2018 | 43% (June); 45% (Dec) |

45% (June) | 56% (June) |

| 2019 | 41% (June); 42% (Dec) |

44% (June) | 56% (June) |

| 2020 | 49% (Dec) | 55% (Dec) | 56% (Dec) |

| 2021 | 44% (Feb); 25% (May); 22% (July); 26% (Aug); 27% (Nov) |

40% (May); 29% (Aug); 46% (Nov) |

42% (May); 39% (Aug); 43% (Nov) |

| 2022 | 36% (Feb); 38% (May); 37% (Aug); 36% (Nov) |

44% (Feb); 40% (Aug); 44% (Nov) |

49% (May); 48% (Aug) |

Did you know that the “real” pass rate for level 1 was always more like 30% than 43%? That’s because even 25% of registered candidates decided to stay at home rather than go to the exam as they felt not ready to take it. Aware of the needs that CFA candidates have and difficulties they face, we help all candidates – regardless of their exam level – stay on the right track with their prep. Our CFA exam study planner 4.0 is based on 3 pillars: control, motivation, and knowledge retention. If you follow our guide, you’ll get yourself responsible and productive exam prep. Should you execute your study plan week by week and learn efficiently while studying, you’re bound to find yourself among those who passed .

What to Do if You FAIL Your CFA Exam? And if You PASS?

After you receive your CFA exam results and let the news sink in, you’ll be surely asking yourself this one little question: OK, what now?

Here’s a list of 6 things you should do if you FAIL your CFA exam (but also if you PASS it):

- Look at your blue line showing your overall performance in the exam.

- Compare your CFA exam topic results.

- Analyze the exam prep you had before your exam.

- Write down all your conclusions.

- Start your next preparation at least 5-4 months before your next exam.

- Have your own personalized CFA exam study plan and make sure you follow it.

Read on for the details. These depend on your personal exam experience.

I Failed My CFA Exam By a Hair’s Breadth

1. Look at your blue line showing your overall performance in the exam:

So, you are close enough to the MPS line to get a bit angry that you didn’t make it? Bummer… Keep your spirits up, though. It means you did quite a good job overall. OK. There are things you’ll need to improve. But the chances are high that your next CFA exam will be a success.

Below we help you identify your weak points, tell you what to focus on to improve, and suggest the best way of studying for you.

2. Compare your CFA exam topic results:

Take your time and scrutinize your topic performance. How many blue topic lines were over or close to the 70%-line and how many – way below? Focus on the latter ‘cos they indicate which topics you definitely need to improve. However, while studying don’t get tempted to neglect the topics you did well at this time. What you need to do is regularly review the contents of these topics and study the bits you felt insecure about. Your next exam may test you on different areas of the topics than it did this time.

NOTE: The visual presentation of your topic performance is meant to help you draw some useful conclusions and aid you prepare for your next CFA exam. Even if it’s far from ideal, it has some valuable information for you if you can give it the right meaning.

3. Analyze the exam prep you had before your exam:

Topics analysis is one thing. But then there’s also an issue of your attitude. There’s always something we can do better. Think what it is for you when it comes to the way you study. Perhaps you lost too much time not following your study plan but postponing your study hours? Or you had no study plan at all?!?! Maybe you practiced too little leaving tests till after you read all the topics? That’s a mistake. You should do exam-type questions systematically all over your exam prep. Practice and theory should intertwine. Then, there’s also an issue of review. Few candidates do it on a regular basis (perhaps that’s why the pass rates are so low…). In your case, spaced revision throughout whole exam prep (not just a week or two before the exam) is especially important! Why? Because while you focus on the topics you need to improve, you also need to review the topics you did well at to make sure you lose no points here next time.

4. Write down all your conclusions:

Better plan? More practice? Spaced review? As soon as you know what to change about your exam preparation, write it down and pin the list in a visible place. It’s the best way to hold yourself accountable. As time passes, all your resolutions will start to fade. But then it’s all there – written down point by point. A sheer look at the list reminds you of what you want to do better this time.

5. Start your next preparation at least 5-4 months before your next exam:

It’s up to you to decide how many months of preparation you need. But we’d like to encourage you to make it at least 5-4 months. This is an average study time period for CFA exam candidates. The shorter your exam prep is, the more intensive it needs to get. Otherwise, you risk ending up with a result like the one you got lately.

6. Have your own personalized study plan and make sure you follow it:

You certainly need a good study plan. And we’re not saying it because we have this CFA exam study planner 4.0 for you. We’re saying it because there’s no other way you can successfully control your whole exam prep. You need to take so much into consideration, now also your personal topics experience, practice needs, spaced review, or whatever it is you want to improve. When using our study planner, you can choose your topic sequence and the difficulty for all topics according to your topic performance in the previous exam. You can also control your progress week by week by summarizing your weekly study achievements. If you opt in for our paid program, you’ll get major motivational boosts (e.g. your Chance-to-Pass-ScoreTM) hand in hand with top study hints in the form of inbox messages to help you develop your study routine. Also, your review sessions will be properly scheduled in your study plan and some extra tools will be available for you to practice more.

I Failed My CFA Exam

By a Lot…

1. Look at your blue line showing your overall performance in the exam:

So, you are close enough to the thick dashed black 10th percentile line to get scared you’ll never make it? Not the way you imagined it?

Here’s what you need to do >> You need to rethink your approach completely! Ask yourself why you WANT to become a CFA charterholder (and how much you WANT it?). Then >> Follow our guide: take this revolutionary road and experience revolutionary effects .

2. Compare your CFA exam topic results:

Not too many satisfactory scores, huh…? Generally, you’ll need to work hard on every topic before your next exam. Unless there’s a topic you did reasonably good at. Perhaps you often use this topic’s concepts at work? Or you simply studied this topic more thoroughly? If the latter’s the case, try to build on this experience and think what exactly made this one topic score different than others?

3. Analyze the exam prep you had before your exam:

Even though you feel devastated by your CFA exam score, you need to know one thing. Not all of your exam prep was a fiasco. There were some bad things and some good things about it. Now it’s time to face the truth and call it all by name. What did you do right? What did you do wrong? This is probably the biggest step for you. Unless you can draw some meaningful conclusions, you won’t be able to carry on successfully.

4. Write down all your conclusions:

This is the only way to take your next exam prep seriously. Divide a sheet into two. Make the TO DO list and the NEVER TO DO list side by side. If you don’t make it, your next exam prep won’t be any different. Again: out of control, poorly executed, and letting your goal get out of perspective.

5. Start your next preparation at least 5-4 months before your next exam:

5-4 months is an average study time period for candidates. However, the shorter your exam prep is, the more intensive it needs to get. Bearing in mind how much work there’s in front of you, you should aim at a sufficiently long exam prep for you. 5 or 4 months may not be enough but we make even 8-month study plans available to our users.

6. Have your own personalized CFA exam study plan and make sure you follow it:

Your next CFA exam prep needs to be revolutionary. That’s why you need a study plan that makes you work! Use this CFA exam study planner 4.0 to stay in control of your preparation. Personalize your study schedule so that it fits you. If it fits you well, it’ll be easier to follow. While customizing: (1) choose your start date and exam date; (2) change your topic sequence to your liking; (3) specify which topics are easy, moderate, or difficult to you; (4) plan your holiday weeks (especially if you’re opting for more than 5 months of preparation – some rest will do you good!); (5) sign in for motivational messages if you feel you lack motivation and a proper review system if you don’t know how to study efficiently. You’re on the right track. Just keep on going .

I Passed My CFA Exam!

New Is Before Me…

1. Look at your blue line showing your overall performance in the exam:

Congrats on passing your CFA exam! The next level’s waiting for you . New exam means a new challenge and new rules. You’ll do best if you start your new preparation with the analysis of your recent achievement. Because the closer you are to the MPS line, the more you may want to improve your studying process.

Below we show how you can do better. And there are at least two reasons why you should aim at doing better. Firstly, each next CFA exam level is harder than the previous one. Secondly, it’s not just a cliché – it’s a fact supported by fairly low and fixed pass rates. Every year, only around 50% of the successful-in-previous-level candidates pass their NEXT CFA EXAM. (The third reason we can think of is your natural desire to grow, which we strongly advocate .)

2. Compare your CFA exam topic results:

Start your analysis by looking at your topic performance. First, look at your Ethics score. Remember you will be tested on the same Code and Standards at each level of your CFA exam. Your latest Ethics result can tell you a lot. If it’s highly satisfactory, it says you should keep on studying Ethics the way you did (also, to a certain extent, it may be a good benchmark for studying other topics). If your Ethics score is unsatisfactory, you know you need to be more serious about this topic now. Also, pay attention to the topics you scored the lowest. Are they your Achilles heel or was it just an accident? That’s important because topics often share some common concepts across exam levels. Identify all the topic areas common for your previous and next exam. Then, think how well you know it and how much you’ll need to improve.

3. Analyze the exam prep you had before your exam:

You never err by asking yourself what you did right and what you did wrong. Your exam prep is no exception. This way you develop your skills and competencies and you grow both as a student and as a human. Perhaps you’d like to be more organized and regular about your study hours? Or maybe you struggled with the motivation to study? Finally, you surely neglected spaced revision. Obviously, it was a mistake because it’s the best way to keep your learning curve up, not falling.

4. Write down all your conclusions:

Better organization? Maintained motivation? Study content revision? All this may be on your growth list. Your next CFA exam prep needs to be more advanced than the previous one because your next exam is going to be more advanced than the one you just passed. And we hope you’re not going to take it easy now just because you were successful once? Your next success is not coming cheap – you need to earn it!

5. Start your next preparation at least 5-4 months before your next exam:

If your previous exam prep was longer than that, feel free to stick to your way. All we’re saying is that the majority of CFA exam candidates do 5-4 months of prep. You need to choose what’s best for you and – since you already had quite a successful exam prep – you surely know it best. No matter the prep length – just make sure you approach your prep responsibly and productively!

6. Have your own personalized CFA exam study plan and make sure you follow it:

A good study plan is a must for every successful exam preparation. We hope you agree. Here you can create your CFA exam study plan and personalize it according to your needs. It puts you in control of your whole exam prep. Week by week you see your progress as you study readings (aka. learning modules). With our paid plan, you also get to know how long to study each reading. These estimations can be particularly helpful since you have no experience in preparing for the next exam level. To keep your motivation strong (and to add some fun to studying), you’ll also get your Chance-to-Pass-ScoreTM estimated and illustrated. It grows when you’re doing fine, i.e. when you mark your readings green for done, summarize your study achievements week by week, or do your spaced revision sessions scheduled throughout your whole preparation. Good luck with your upcoming prep!

CFA Level 1 Result 2022: Chartered Financial Analyst Institute (CFAI) has released the CFA result of November 2022 session on January 12, 2023. The institute has also sent an email to the registered email account of the candidates regarding the CFA level 1 result. The candidate will receive a «pass» or «fail» rating, as well as information on their performance on each topic in the CFA level 1 2022 exam. Along with the result, the institute will also announce the pass percentage of CFA exams. The institute released the result of CFA level 1 for August 2022 session on October 04, 2022 and the result of May 2022 session was declared on July 30, 2022. Read the complete article to know how to download CFA level 1 result 2022, dates, pass rates, and much more.

Stay up-to date with CFA Exam News

As per the CFA level 1 exam dates, the institute will conduct the exam for February 2023 session CFA level 1 from February 14 to 20, 2023. The CFA 2023 result for level 1 will be announced within 60 days after appearing for the exam.

CFA Level 1 Exam Result 2022 — Highlights

-

CFA level 1 result 2022 will be available about 8 weeks after the examination is held.

-

After the testing is completed and the exam window closes, CFA Institute undertakes a detailed review of exam questions and candidate performance in order to determine the minimum passing score that demonstrates basic subject matter competency.

-

Candidates will get periodic notifications to keep them informed about the status of their CFA Level 1 result, and as new information is available, it will be posted on the official website.

CFA Level 1 Result — Important Dates

|

Events |

May 2022 |

August 2022 |

November 2022 |

February 2023 |

|

CFA level 1 exam dates |

May 17 to 23, 2022 |

August 23 to 29, 2022 |

November 15 to 21, 2022 |

February 14 to 20, 2023 |

|

Declaration of result |

July 30, 2022 |

October 4, 2022 |

January 12, 2023 (Out) |

To be notified |

Steps to Download Result of CFA level 1

The following are the steps to check your CFA exam results:

-

Log on to CFA’s official website — www.cfainsistute.org.

-

Select the CFA level 1 course.

-

Enter the verified credentials: Email address and password.

-

Select the result option to see the results.

-

The detailed CFA level 1 result will be presented on the screen.

-

You may download the result of CFA level 1 for future reference.

Students Also Liked:

-

Online Degree and Diploma Courses

-

Online Free Courses and Certifications

-

Online Short Term Courses and Certifications

-

Online Certification Courses

-

View all Online Courses and Certifications

CFA Level 1 Result 2022 — Minimum Passing Score

-

The minimum passing score for the CFA level 1 exam, as well as the CFA level 1 results for each window, will be announced by the authorities.

-

Applicants can use the CFA exam performance guidance on the official website to get their percentile rank.

-

To qualify for the CFA level 1 exam 2022, candidates must score higher than the MPS (Minimum Passing Score).

-

The minimum passing score varies every session, and candidates who do not meet the MPS can retake the exam.

CFA Level 1 Result 2022 — Pass Rates

According to reports, the pass rate of CFA level 1 for August 2022 was 37 percent. The candidate might look at the pass rates from previous years to get a sense of the exam’s complexity and competition and prepare accordingly.

CFA level 1 pass percentage

|

Session |

Total Candidates |

Passed Candidates |

Failed Candidates |

Pass percentage |

| August 2022 | 19,103 | 7068 | 12035 | 37% |

| May 2022 | 19,403 | 7,315 | 12,088 | 38% |

|

February 2022 |

18,992 |

6,801 |

12,191 |

36% |

|

November 2021 |

28,170 |

7,607 |

20,563 |

27% |

|

August 2021 |

16,026 |

4,211 |

11,815 |

26% |

|

July 2021 |

28,849 |

6,468 |

22,381 |

22% |

|

May 2021 |

26,005 |

6,506 |

19,499 |

25% |

|

February 2021 |

28,683 |

12,510 |

16,173 |

44% |

|

2020 |

26,212 |

12,806 |

13,406 |

49% |

|

June 2019 |

83,656 |

34,585 |

49,071 |

41% |

Popular Online Finance Courses and Certifications

-

Online Banking And Finance Courses

-

Online Finance Courses

-

Online Fintech Courses

-

Online Gst Courses

-

View All Online Finance And Accounting Courses

Frequently Asked Question (FAQs) — CFA Level 1 Result Nov 2022 (Declared)- How to Download, Minimum Passing Score

Question: What was the minimum pass rate for CFA level 1 exam for May 2022?

Answer:

The minimum pass rate for the CFA level 1 exam for May 2022 is 38%.

Question: When will the CFA level 1 Feb session exam be held?

Answer:

The CFA level 1 exams for the Feb session will be held from Feb 14 to 20, 2023.

Question: Where can we find the CFA level 1 result?

Answer:

The CFA level 1 result will be announced on the official website — www.cfainsistute.org.

Question: How long does it take for the results of the CFA Level 1 exam to be released?

Answer:

The results are announced around 60 days following the CFA level 1 exam.

Latest Articles

Questions related to CFA Exam

Showing 24 out of 24 Questions

3454 Views

how to clear CFA exam in first attempt

Hi,

Try preparing smartly and efficiently.

- Be very disciplined with your study schedule. The output is more when you give 2 hours daily for 7 days then 14 hours on only weekends (generally).

- Study with the sense of doing questions and clearing exams. It will help you to clear L1 but may prove harmful for L2 as it demands deep inter-topic clarity.

Just a tip, in case you have less time and you are good to grasp new concepts — try preparing from Schwezer Notes and Videos for Level 1. But for Level 2 and 3 you have to put in the required efforts.

It is not difficult to crack CFA Level 1 without coaching. You just go through the curriculum topics one by one and do practice a lot of questions. Also in case you do not have much time, you can go through Schwezer notes for Level 1 through and practice the papers on CFA website.

In case you do not understand any particular subject, there are coachings available for particular subjects. You can opt for that rather than going for all the subjects. Plus there are video lectures available which help a lot.

Hope this helps.

Good luck.

In recent sittings, CFA Institute has changed the way a candidate’s exam performance is reported. The new format of the CFA® exam results gives a wealth of information on performance overall, performance compared to the minimum

passing score, performance compared to other candidates, and performance by specific topic. Used properly, this breakdown can be a vital tool in organizing your studies for the road ahead.

Overall exam performance

CFA Minimum Passing Score

The minimum passing score of the CFA exam is illustrated with a dashed line and is the most important piece of information. Your exam score will be represented as a blue solid line, and if that’s above the minimum passing score, then congratulations, you’re on to the next level or filling out your membership

application.

Good news!

If your score is not above the minimum passing score, there’s a lot of other useful information in the report that you can, and absolutely should, use to plan your CFA exam re-take strategy for the next attempt.

What is the CFA Exam Confidence Interval?

The CFA exam confidence interval represents the range by which your score may have been affected by favorable or unfavorable testing factors and is illustrated by a light blue sharing around your exam score. The light blue shading around your exam score is a 90% confidence interval.

The top end of the confidence interval represents the score you could expect if everything went exactly as you’d hoped on the day of the exam—you felt great, the right questions came up, and the candidate next to you had no distractingly annoying habits.

The bottom end of the confidence interval pretty much signifies the opposite. This represents the score you could expect if your weakest areas were examined and you had a bad day during the exam.

In the example below, it’s likely the candidate would have failed even with an ideal set of circumstances. Even the top end of the confidence interval is below the minimum passing score. In this case, we’d recommend critically re-examining the whole approach to CFA exam prep.

Not such good news

The most common reason people fail the CFA exam is simply the time commitment. If life got in the way, and you didn’t put the hours in, it’s an extremely difficult exam to pass due to the sheer volume of information you need to retain.

Almost as common, however, is a lack of question practice. Many candidates read the materials for four months, practice questions for a few weeks, and do a mock exam or two. Undoubtedly, this will leave areas of the syllabus that you’ve read, but

on which you’ve not practiced enough questions. This will hurt in the exam. If you don’t know how a reading is typically tested, you’re likely to be met with unexpected and hence tricky questions on exam day.

Our recommendation is questions,

questions, questions from the outset. If you have a two-hour study session planned, an hour of it should be question practice, starting on day one. Your last month should be saved almost exclusively for mock exams.

Sign up for our CFA question of the day and get a CFA question sent directly to your inbox every day to help prepare for the next sitting.

CFA Exam Percentiles

The final aspects of the overall score report for the CFA exam are the 90th and 10th percentiles. Only 10% of candidates scored higher than the 90th percentile. If your mark is anywhere up there, it’s safe to say you crushed it. At the other end of the interval,

90% of candidates scored better than the 10th percentile. If you find yourself dipping down there, again it’s a sign that you need to commit to significantly more study time or fundamentally alter your study approach.

90th percentile (above the MPS) and 10th percentile (below the MPS)

Kaplan Schweser’s CFA exam prep materials are an excellent way to get the guidance you need through this process. Schweser’s unique online study program guide will ensure you put the time in and, equally as important, focus on the right areas with the right balance of preparing (reading notes and attending classes), practicing (doing questions), and performing (completing practice exams).

Step-By-Step CFA Exam Grading Process >>

CFA Exam Results Topic Breakdown

In addition to the overall pass or fail information, the CFA exam report also gives a breakdown by topic.

A pass on a «good day»

«The report shows the candidate’s mark and 90% confidence interval for each topic. There is no minimum passing score for each topic, so instead the topic mark is benchmarked against 70%—a score that demonstrates a “reasonable level of

topic mastery.” In other words, hit 70% in a topic, and you’ve certainly done enough to pass in that area.

Don’t underestimate the little guy

In this example, we have a typical breakdown for a theoretical Level I candidate who was an “almost pass.” The candidate has performed well on FRA, achieved over 70%, and set themselves up for a pass. But derivatives has dropped well

below the level of reasonable mastery. FRA clearly deserves a lot of study at Levels I and II. It’s voluminous, often not intuitive, and represents a significant chunk of the exam.

But it’s important not to give it too much attention in

your studies at the expense of other areas. A poor performance in several of the relatively smaller topics, such as derivatives and alternative investments at Level I, sometimes adds up to a narrow fail despite mastery of the bigger areas.

Often, we see candidates with results reports like this for a couple of reasons:

- The candidate spends too long trying to master 100% of the largest topic (you can’t and won’t).

- The candidate simply doesn’t make it to the end of the syllabus.

As a result, smaller topics get overlooked. “They’re too small to worry about’’ is a common argument against bothering with these areas. But add them up, and they often rival the weighting of the bigger areas for which candidates

are willing to over-study.

The best way to address this next time around is to leave enough time for plenty of CFA practice exams. The last five or six weeks should involve practice exams and debriefs, along with short review sessions learning factual areas (via self-testing). The

beauty of a practice exam is that it forces you to weigh the topics in the correct manner. You see every topic in its correct weighting, and a thorough review of the results should reveal the areas in which you’re exposed.

It’s also worth noting the position of the percentiles and the width of the confidence intervals. Smaller topics will inevitably have wider intervals (smaller sample size—Level I quant again). But it’s also worth noting that a lower

90th percentile and a higher 10th percentile, and a narrow confidence interval, indicate a harder topic. A reasonable mastery in these topics indicates a very strong performance.

CFA Results Interpretation Summary

We’re all hoping the thick blue line is above the minimum passing score. But if not, don’t ignore the valuable information you have here. An unsuccessful attempt is by definition a result of an unsuccessful study approach. Whether it was a

lack of time, a lack of question practice, or a lack of focus in the right areas, you can assess what needs to be put right. With the most experienced and largest full-time faculty, Kaplan Schweser has

the blend of CFA study materials, question practice, mock exams, and classes that can aid both your technical mastery and exam technique.

Results notifications timetable

CFA UK’s results and certification timetable is as follows:

|

Provisional results notification (In person) Provisional results (Online) Official results confirmation (Post) |

On the day of the exam at the test centre 3 working days after examination Within 21 days after the examination |

Important information

- Please ensure your contact details are current and correct, CFA UK will not be held responsible should you not receive your official confirmation letter or certificate. All requests for a change of address must be made in writing to qualifications@cfauk.org

- CFA UK does not release the exact score or provide details of which questions candidates answered correctly or incorrectly.

- All CFA UK exams are pass or fail exams.

- Results (provisional or official) will not be given over the telephone.

- All results are provisional until the official confirmation is issued.

- Candidates must notify CFA UK if official confirmation not received within 3 months of the exam date to receive a replacement certificate. After 3 months candidates will be required to pay for a replacement certificate.

The pass mark

When CFA UK examinations are constructed, an average difficulty for the whole examination is established and this determines the correct pass mark. The average difficulty may vary slightly from one examination to the next, but this is carefully balanced by slight variations in the pass mark using psychometric analysis. In this way we are able to keep the pass challenge strictly consistent between examinations and over time.

Although we do not rigidly fix the pass mark (for the psychometric reasons stated) the pass marks seldom vary from the following:

- IMC Unit 1 — between 65% and 75% of all scored questions

- IMC Unit 2 — between 60% and 70% of all scored questions

Pass rates

There are no test ‘hurdles’ in CFA UK examinations. To pass the examination, candidates need to achieve an overall pass score regardless of where the marks were distributed throughout the examination.

Next steps after the results

Regardless of the result all candidates will be sent an official confirmation

| Pass | Fail | Absent |

| Total score or grade will not be provided | View areas of weakness online 3-5 working days after examination | Reregister and pay the full exam fee before scheduling new exam sitting |

| A breakdown will not be provided | Reregister and pay full exam fee before scheduling new exam sitting | Apply for Special Considerations if candidates have experienced adverse circumstances |

| Passed single IMC unit register for next unit to gain Full IMC | ||

| Full IMC achieved Become an IMC member | ||

| Passed Certificate in ESG Investing, register for the IMC to gain IMD |

Areas of weakness

These are only provided when candidates fail an examination.

When candidates’ overall mark falls short of the required pass mark they will receive an ‘Overall Weakness’ level which is categorised further to provide a rough indication of where the candidate lost marks.The Areas of Weakness are not part of the scoring process and do not form part of the examination result.

Key for Areas of Weakness:

| Slight 1 — 5% |

Moderate 6 — 15% |

Severe More than 15% |

| Percentage short of standard required to pass |

Replacement certificate

Candidates can request a replacement certificate. All requests are required in writing (via email or post) containing the following information:

- Candidates full name

- Candidate Date of Birth

- A photocopy / scanned copy of the candidates passport or UK photo drivers license

- Payment for the £30 charge for the replacement certificate can be made by:

- Completing & sending the payment form and we will call the candidate to obtain card payment or

- Posting a cheque to CFA UK made payable to ‘The CFA Society of the UK’.

Please note that the replacement certificate will be posted to the candidate only.

Join CFA UK as a IMC member

To be eligible, you must have gained the Full IMC qualification first, once you are a member you can benefit from:

- Using the IMC designation after your name to showcase your qualification

- Taking advantage of our career support services including 20 free career-related events per year and access to our Careers Centre

- Attending networking and educational events and conferences, with over 50 events per year free to members

- Getting unlimited access to our online resources where you will find filmed events and webcasts

- Getting involved in the investment community as a volunteer.

Since the CFA Exam is offered two and four times a year, CFA Exam results are released two to three months after your CFA exam date.

- You’ll receive Level 1 or Level 2 results by email 60 days after the exam.

- You’ll receive Level 3 results by email 90 days after the exam.

Given the volume of emails, do not expect to receive the results immediately after 9 a.m. Readers seem to get it half an hour to a few hours later. The results will also be shown online the next day after 9 a.m. ET.

What’s in the CFA Exam Results Email?

Explanation of the Report

On each report, there will be an indication of either a “pass” or “did not pass,” as well as a table showing your relative performance by topic area.

The ≤50%, 51-70%, and >70% intervals are known as score bands. They indicate your performance relative to those who fail the exam. The CFAI, however, doesn’t specifically explain how this is calculated.

A Note on Score Bands

Score bands are useful only to show your relative strength and weakness across topic areas.

You can’t compare the score bands with those in previous exams because the overall performance of all candidates can be different from one exam to another.

It is possible for two candidates to get the same performance breakdown, but one passed and the other failed. This is because performance is reported as a range, and it is hard to compare individuals with a range.

CFA Fail Bands

If the score is a fail, an additional indication of Band 1-10 will be provided, with 10 being the closest to a pass.

Band 1 means the candidate did better than at most 10% of those who also failed. In other words, 90% of test-takers did better (which is not good). For Band 2, the candidate did at most 20% better than fellow failed candidates, and so on.

This is why if you are in Band 10, you are almost there.

The Minimum Passing Score

The CFAI determines a minimum passing score for each exam. This number is not disclosed, but you can learn about the process and its impact on grading here.

Borderline Cases

You won’t know for sure if you are a borderline passing case. All your score report will say is that you passed. However, if you fall into Band 10, you are for sure a borderline fail. Take note of these factors before your next attempt:

The Ethics Adjustment

Those with scores pretty close to the minimum passing score may have scores adjusted to a pass if there is a strong performance in the ethics section and vice versa.

Here is a direct quote from the CFAI website:

The Board of Governors instituted a policy to place particular emphasis on ethics. Starting with the 1996 exams, the performance on the ethics section became a factor in the pass/fail decision for candidates whose total scores bordered the minimum passing score. The ethics adjustment can have a positive or negative impact on these candidates’ final results.”

If you didn’t do well on ethics, this is surely an area you can work on!

Retabulation Requests

If you are thinking about a score review, there is a retabulation service.

This is a process to make sure your score is totaled and recorded correctly. For the multiple-choice and item-set sections, this process involves a CFA Institute staff member manually pulling your answer sheet from the pile, checking the answers against the answer key, and ensuring the total score is calculated correctly.

The essay section is also an exercise to confirm the score is totaled and recorded correctly. It does not involve re-grading.

You can fill out a request form within 30 days of the results release, pay US$100, and get the results after a week.

Given the extremely low chance of the CFAI making this type of error, I personally wouldn’t pay for retabulation myself.

If you are looking for an appeal or re-marking of an essay, this is unfortunately not available.

You can download the request form and ask questions about CFA exam results at info@cfainstitute.org.

Have You Heard of the 40/60/80 Rule?

There have been creative ways to develop an individual “CFA exam score” using this formula. You assign 40% to the topic areas in the ≤50% band, 60% to 51-70% band, and 80% to >70% band. Then multiply the 40%/60%/80% with the respective “max points,” divided by the total number of max points.

An Example Score

Here’s a sample multiple-choice score.

|

Topic |

Max Points | ≤50% | 51-70% |

>70% |

| Alternate investments | 8 | ✔ | ||

| Corporate finance |

20 |

✔ |

||

| Derivatives |

12 |

✔ |

||

| Economics |

24 |

✔ |

||

| Equity investments |

24 |

✔ |

||

| Ethical & professional standards |

36 |

✔ |

||

| Financial reporting & analysis |

48 |

✔ |

||

| Fixed income investments |

28 |

✔ |

||

| Portfolio management |

12 |

✔ |

||

| Quantitative methods |

28 |

✔ |

Here’s how you’d apply the 40/60/80 rule.

|

Topic |

Max Points | Multiply by |

Approximate Points |

| Alternate investments |

8 |

0.4 |

3.2 |

| Corporate finance |

20 |

0.6 |

12 |

| Derivatives |

12 |

0.4 |

4.8 |

| Economics |

24 |

0.4 |

9.6 |

| Equity investments |

24 |

0.8 |

19.2 |

| Ethical & professional standards |

36 |

0.8 |

28.8 |

| Financial reporting & analysis |

48 |

0.8 |

38.4 |

| Fixed income investments |

28 |

0.8 |

22.4 |

| Portfolio management |

12 |

0.8 |

9.6 |

| Quantitative methods |

28 |

0.6 |

16.8 |

|

Total |

240 |

164.8 |

According to the 40/60/80 formula, this candidate scored approximately 164.8 points out of a possible 240. That equates to a score of about 69% correct.

How Accurate is this Estimate?

This is a very rough estimate, to say the least. Neither the CFAI nor any other party has confirmed this formula. I also suspect that the CFAI doesn’t disclose exact scores for a reason. Feel free to do this for fun, but I wouldn’t get too hung up on it.

Your Next Step

If you pass…

Congrats! You may consider registering for Level 2 as early as the day after your receive the results email. If it’s in your plan anyway, I encourage you to do that before you forget about it and miss the early-bird discount.

Thanks to the new scheduling system, you no longer have to decide between waiting either four months or 16 months before you can proceed. It’s pretty much the same process as Level 1. Here is how you do it, in case you don’t remember.

Check out Level 2 Topics + Tips!

If you fail…

Bummer. But, hey, about 60% of candidates fail every year. So don’t give up! I bet most candidates fail at least once along the way. John included (he failed Level 3 once).

If that’s the case, evaluate, revise your study plan and try again.

Start your self-evaluation here>>

For Your Further Reading

- Minimum passing score and how the CFA exam is graded

- CFA exam historical pass rates

- CFAI information on exam scores and bands

What can your CFA exam results charts tell you? More than you may think.

To help you get the most out of your CFA exam results, we’ve put together a clearcut guide with:

- CFA results samples,

- step-by-step guidance on how to interpret CFA results charts, and

- how you can use this to improve your performance.

Understanding your results charts can really help you in facing your next exam – use the tips in this guide and take the time to analyze your results!

Contents

- How do the CFA exam results look like?

- How to read your CFA exam results charts

- How to read your CFA exam topic performance chart

- CFA Level 3: How to read your essay and item set chart

- Got your results? Put them on your resume and LinkedIn profile, the right way.

- Help our research. Send us your results PDFs.

How do the CFA exam results look like?

CFA Institute changed the way they report CFA candidates’ results in December 2017, the first time this has happened in at least 10 years.

Candidates now receive a pass/fail result through email around 60-90 days after exams (see our predicted results release dates here), and can retrieve a PDF of their results charts from CFA Institute.

Although they don’t reveal your actual scores, the details that they do share allow you to interpret how well or badly you did, and use that information to better prepare for the next exam, whether you’re retaking or advancing to the next level.

Want a sample of the real thing? You can download CFA exam results samples PDFs for any level using the buttons below:

CFA results first page: Results summary

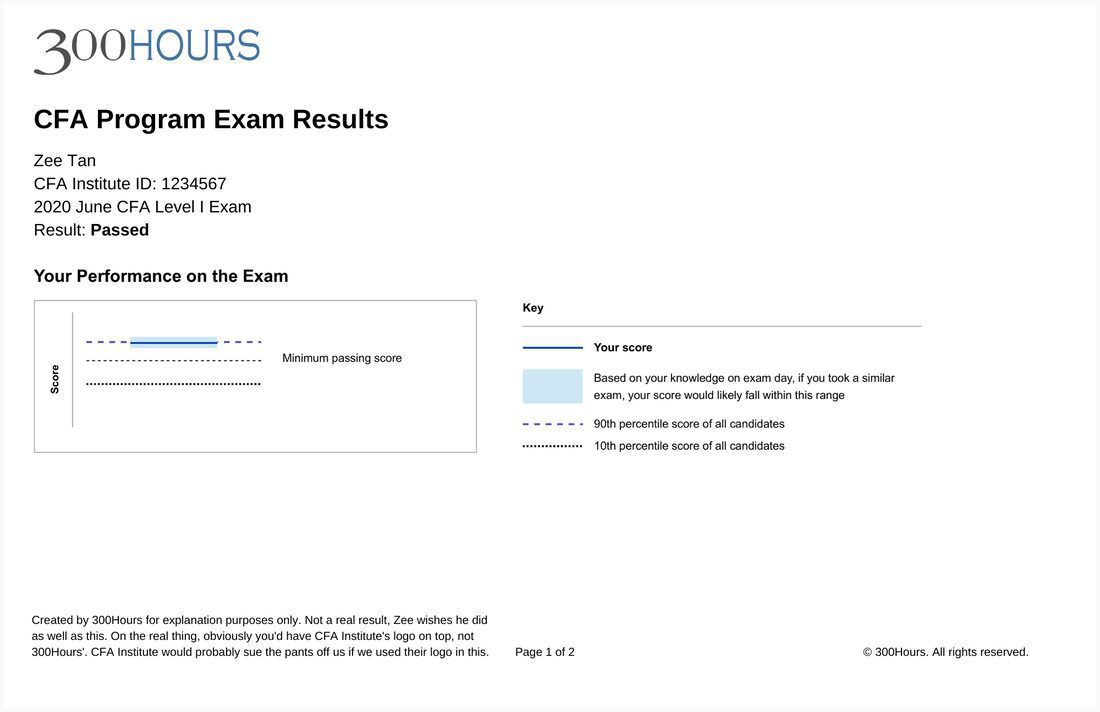

The first page of the CFA exam results PDF shows your pass/fail score, as well as your overall exam results chart.

CFA results second page: Topic performance charts

The second page shows your performance on a topic-by-topic basis.

[Level 3 only] CFA results third page: Essay and item-set performance charts

If you’re receiving your CFA Level 3 results, you get a third page showing your essay and item-set performance charts.

How to read your CFA exam results charts

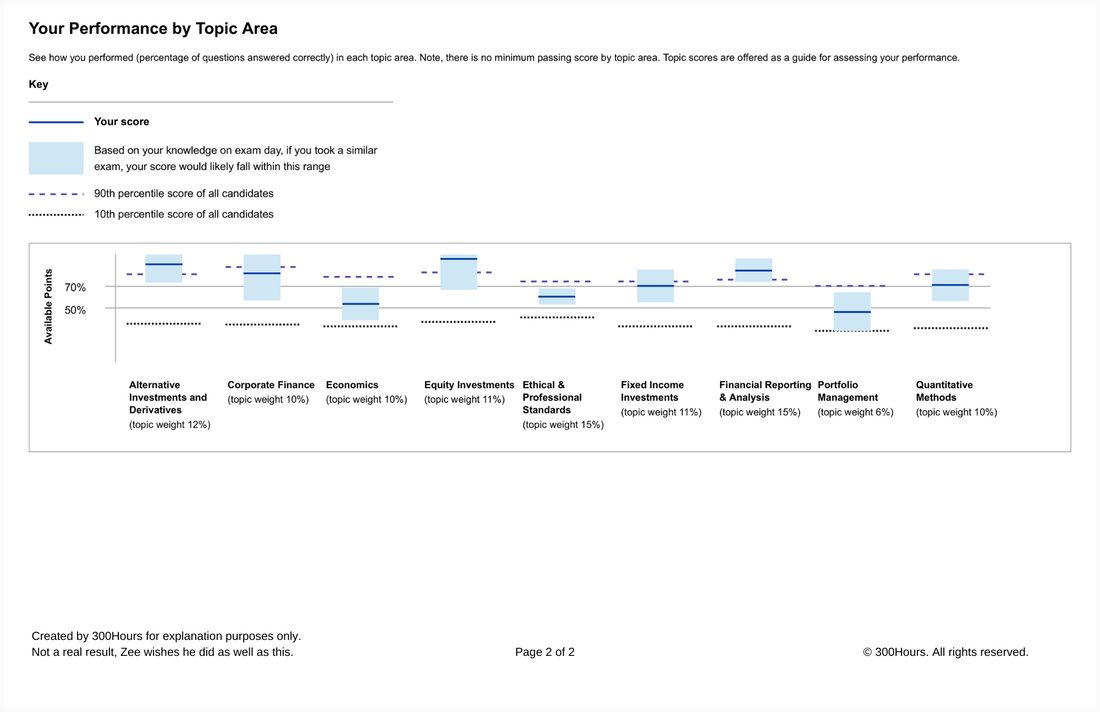

Your CFA exam results chart will look something like this:

At first glance, this may just look like a haphazard mishmash of lines, patterns and colors, but it’s actually quite easy to read once you understand what the lines mean.

Let’s go through them one by one.

The minimum performance score (MPS) line

The MPS line is represented as a thin black dashed line on your exam results charts.

In your exam performance chart, the MPS represents the minimum score a candidate has to achieve to pass the CFA exam.

Any score below the MPS will not pass, although borderline cases might be able to scrape a pass from the ethics adjustment (more detail on that here).

Your score line and score box

Your score line represents your score in the actual CFA exam. A score line below the MPS line means you failed, whereas a score line above the MPS line means you passed.

The score box brings it one step further – CFA Institute reasons that your score line represents only one snapshot of your performance and level of preparation.

The score box is therefore CFA Institute’s estimate of your performance given different sets of circumstances, such as:

- The actual exam topic mix favored, or did not favor your topic mastery

- Your state of rest and alertness during the exam

- Lucky or unlucky guesswork

- Actual exam conditions

The top part of the score box represents an estimate of your ‘best-case score’ if all factors went your way, whereas the bottom part of the score box shows your ‘worst-case scenario’ if all factors for you, well, sucked.

The 90th percentile and 10th percentile lines

To give additional context, CFA Institute also show where the scores of the 90th and 10th percentiles of the total candidate pool.

What can we conclude from the 10th percentile and 90th percentile lines:

- 10% of candidates for that exam performed better than the 90th percentile line.

- Given that the pass rate for the CFA exams are about 40%, this means about 1 in 4 passing candidates would perform above the 90th percentile line.

- 10% of candidates for that exam performed below the 10th percentile line, or about 1 in 6 failing candidates.

- 80% of candidates therefore scored between the 10th and 90th percentile lines.

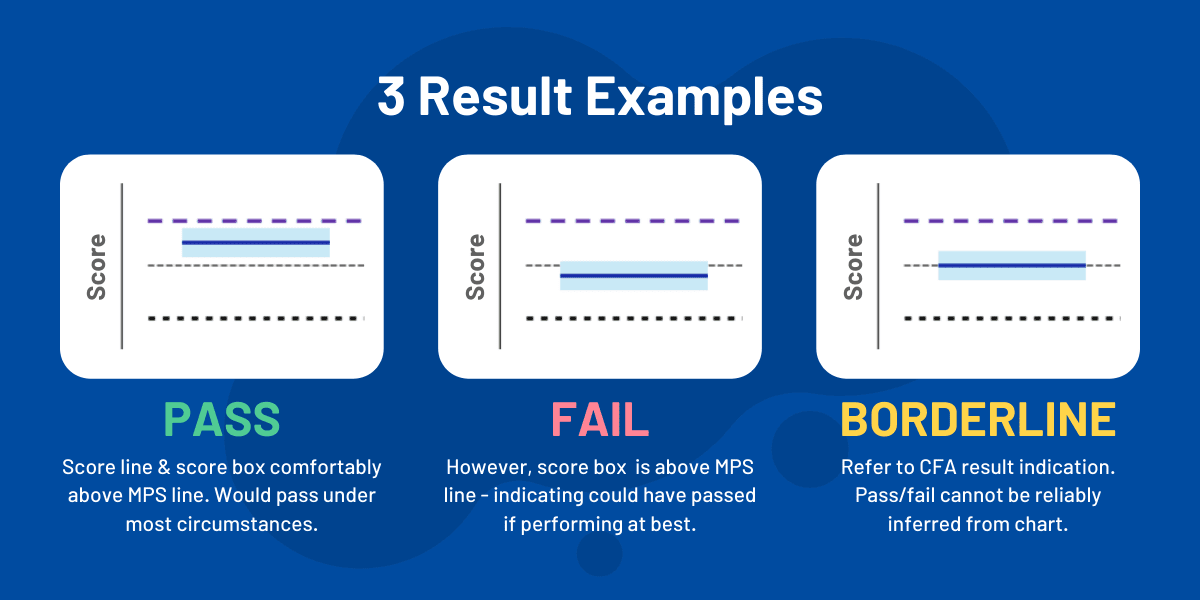

Reading and interpreting the CFA results chart

The image above shows the three basic cases how your results might look like.

Interpreting the lines on the chart is quite simple:

- If your score line is above the MPS, you passed.

- If your score line is below the MPS, you failed.

- The higher the score line, the better you did in the exam.

The chart is just to illustrate your relative performance – the final pass/fail result is stated clearly on the first page.

You probably would have noticed from the charts that the y-axis doesn’t actually have values, so unfortunately you don’t know what the MPS is, nor your actual score.

(We’ve estimated the MPS for every CFA exam since 2012 though, in case you’re curious.)

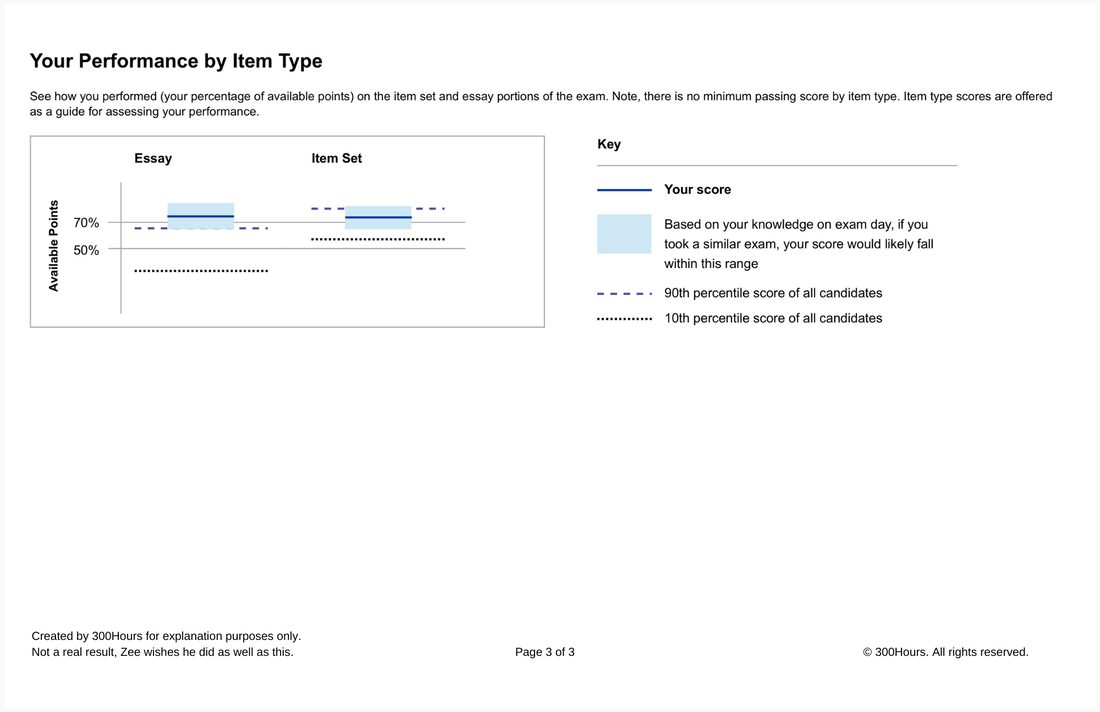

How to read your CFA exam topic performance chart

Looking for guidance on what CFA exam topics to focus on? Your topic performance chart can show you a wealth of information if you know how to interpret it properly.

Here is an example of a topic area performance chart, and our analysis:

How can you analyze your own results charts? Pay attention to these metrics below.

The 70% line and 50% line

There is no minimum passing score for each topic area, so CFA Institute shows a 70% line as a reference point – representing 70% of available points for that topic.

According to CFA Institute, ‘although this level is somewhat arbitrary, consistent scores above 70% of the available points is a reasonable signal of topic mastery.’

Recent results also includes a 50% line, although this has varied across the years – some years did not include a 50% line.

Our analysis into previous MPS scores also tell us that if you reliably score above 70% for all topic areas, you should expect a passing score – although there are obviously no guarantees.

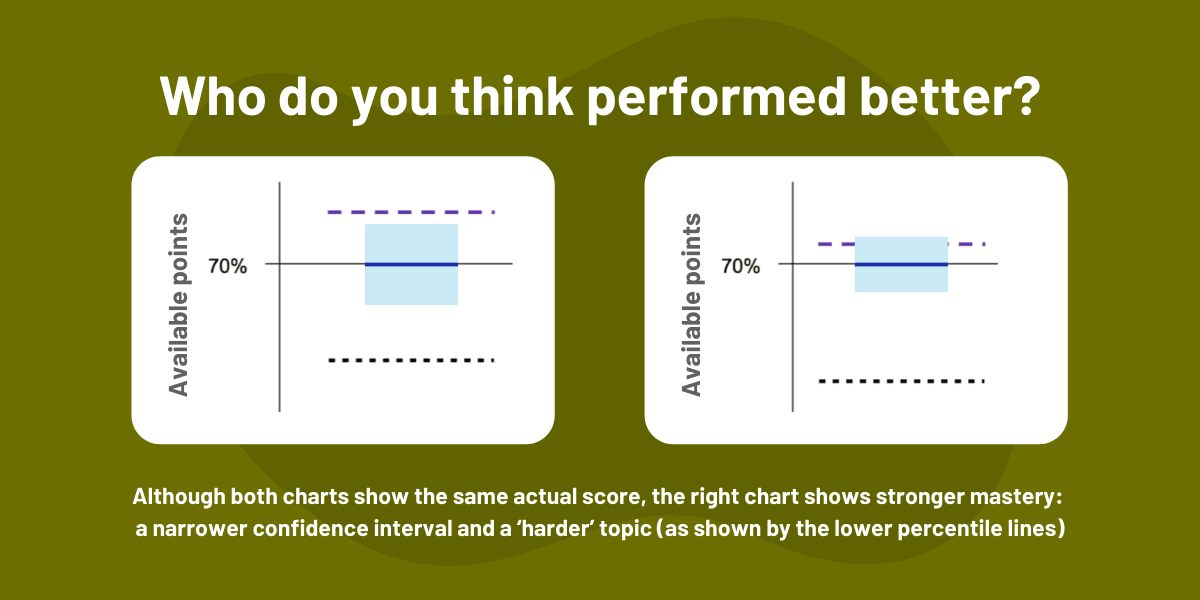

Pro tip: Assess your score box size and percentile lines

Wider score boxes (i.e. confidence intervals) mean lower consistency

You’ll also notice that the score boxes in the topic area charts are a lot wider than in the results chart.

This is naturally due to fewer questions per chart (i.e. smaller sample size), and sometimes with a wider dispersion of responses.

Higher relative position to 10th and 90th percentile lines shows a better performance

Looking at the chart above, although both score boxes show the same score, the score on the right is much closer to the 90th percentile line, showing a better performance than the one on the left.

How to identify topics to focus on and ways to improve

By evaluating your own score, your score box, and the scores of other candidates via the 90th and 10th percentile lines, you should be able to identify the topics you did well in, and the topics you should focus on, and HOW you should work on them.

Going back to our initial example, we see low-performing topic areas, but for different reasons. Corresponding to the numbers in the chart:

- The actual score line and upper end of the score box both did not perform well in either the absolute scale or the percentile scale. Improvement is needed significantly.

- These were the best performing topics, but the score was still significantly under 70%. These do need to improve, but other topics need focus first, especially since these are lower-weighted topics.

- This had a low score, but a large score box. This suggests that the candidate could have performed well in this topic area. Recommend a quick review and emphasize focus on practice questions.

- Low and narrow score box – suggesting that the candidate would consistently perform poorly here. The implication is that base knowledge in this topic is low. Need to invest more time to better understand topic.

- Good scores in these topic areas, with high consistency. Maintain your performance here and you should have no problems.

Hope the examples above help you understand your own chart!

CFA Level 3: How to read your essay and item set chart

In the Level 3 exam, the exams are divided into structured response (‘essay’) and item-set questions.

CFA Institute has also indicated that their results details will include a performance chart split by item type, so that you can compare your performance and see whether you were a stronger performer in the essay paper, or the item-set paper.

Our own analysis on exam data has shown that candidates are highly likely to perform better in the item-set paper.

Got your results? Put them on your resume and LinkedIn profile, the right way.

Want to flaunt your new CFA status professionally? Read our definitive guide on how to update your CFA status on all professional communication, including your CV/resume and LinkedIn.

Help our research. Send us your results PDFs.

If you’d like to help us better understand the results format, just send your results PDF to results@300hours.com.

We understand the trust that you are giving us when you do so, and will not be sharing your information with anybody else, and will only use it to perform anonymised analyses that continue to help present and future CFA exam candidates.

If you’re expecting your CFA exam results soon, good luck! If you have any more questions on understanding your results, just pop them in the comments below.

Мечта

В далеком 2014 году я узнала о программе CFA. В то время я занималась кредитным анализом, работала с финансовой отчетностью по российским и международным стандартам. Однажды мой руководитель скинул в общий доступ учебники Schweser Notes for the CFA Exam (Level 1). В них я нашла много полезной информации по анализу финансовой отчетности и особенностям МСФО. Я поняла, что программа CFA ориентирована на практиков (для меня это ее основное преимущество) и может помочь мне приобрести необходимые знания в профессиональной области. Кроме того, коллеги говорили о программе CFA с пиететом, окончившие программу (CFA Charterholders) имели репутацию профессионалов, а сдавшие экзамен первого или второго уровня (CFA Candidates) считались умными ребятами.

Так у меня появилась мечта сдать экзамен CFA, для начала первый уровень (Level 1).

Но с реализацией мечты было все непросто. Я заказала на eBay один из калькуляторов, которые разрешены на экзамене — Texas Instruments BA II Plus Professional.

Начала самостоятельно заниматься, но огромный объем материала на английском и сложные темы, особенно Quantitative methods, выбили почву из-под ног, и я отложила учебники.

Поворот не туда

Спустя некоторое время я решила подойти с другой стороны и записаться на курсы. Цена курсов Ernst & Young кусалась, поэтому я нашла курс подготовки к CFA в МГУ. В конце 2015 года он стоил 45 000 рублей за 2 месяца. Поехала записываться в главное здание МГУ на Воробьевых горах. Предварительное собеседование проводила доцент кафедры финансов и кредита. Она расспросила меня о профессиональной деятельности и говорит «Знаете, курс «Подготовка к CFA Level 1» простенький, для юных студентов, вы там не найдете ничего интересного. У нас есть трехмесячный курс «Управление финансами компании», там преподают самые лучшие, и он вам точно будет полезен». Видимо, эти слова отразились эхом от стен старейшего университета России и срикошетили мне в голову, да так, что я записалась совсем не на тот курс, на который планировала, да еще и стоящий на 15 000 руб. дороже.

Курс «Управление финансами компании» оказался действительно полезен, но совсем в другом смысле. Я навсегда уяснила, что офлайн курсы в принципе плохая идея. Вечером после работы тратишь время, чтобы добраться до места, уставшая с трудом слушаешь лекцию, а потом еще ехать домой. Оказываешься дома поздно и совсем без сил, а утром на работу. Времени разбирать прослушанный на лекции материал практически нет. Да и не весь материал курса тебе нужен и интересен, но сидеть и слушать приходится все, что говорит преподаватель. Из полезного, говоря на тему налогообложения, преподаватель напомнил о типах налогового вычета, и я поспешила сделать налоговый вычет на обучение, вернув небольшую часть потраченных на курс денег:) .

В 2016 году я перешла на хорошую, но уже не связанную с финансовым анализом должность. Затем на первое место в жизни вышли личные дела: свадьба и долгий ремонт. Дел было невпроворот, и несколько лет об идее сдать CFA я почти не вспоминала.

Цель

В начале 2021 года меня накрыл экзистенциальный кризис. Как это у всех бывает, я вдруг четко осознала давно вертевшуюся в подсознании мысль: «На текущей работе я уже все знаю и умею, она давно не дает мне ничего нового. Нужно двигаться дальше, иначе деградация».

Я захотела вернуться к финансовому анализу и развиваться в этой области, но чувствовала, что нужно освежить знания и усилить резюме. И тут я вновь вспомнила про СFA. На этот раз аргументов в пользу этого экзамена было еще больше. В стране начался настоящий инвестиционный бум, и хотелось лучше разобраться в акциях, облигациях и деривативах. А этим темам посвящена значительная часть программы СFA. Кроме того, востребованы направления Big data и Data Science, где помимо программирования нужны знания статистики. А в разделе экзамена CFA Quantitative methods есть и статистика, и теория вероятностей, и методы тестирования гипотез.

Благоприятствовали еще два важных обстоятельства. Во-первых, за эти годы у меня сильно вырос уровень английского, особенно профессионального, и изучить тысячи страниц учебников уже не было сложной задачей с точки зрения языка. Во-вторых, вследствие коронавируса я начала работать удаленно. Удаленная работа позволила найти время на систематическую подготовку к экзамену.

Подготовка

Я решила сдать экзамен в ноябре 2021, дав себе на подготовку почти 10 месяцев. При стандартной регистрации стоимость экзамена 1 000$, а при ранней 700$. Кроме того, нужно заплатить единовременный взнос за участие в программе CFA в размере 450$.

Для того, чтобы оплатить экзамен по цене ранней регистрации мне нужно было зарегистрироваться до 9 мая. Но сначала я решила проверить себя и изучить пугающие Quantitative methods, на этот раз серьезно. Изучила, но потратила на них непозволительно много времени (аж 2 месяца) и зарегистрировалась в первых числах мая на экзамен.

В целом я заплатила 700 + 450 = 1 150$.

После регистрации и оплаты я получила учебники CFA Program Curriculum в электронном виде и доступ к обучающей экосистеме (Learning Ecosystem).

В учебниках CFA Program Curriculum материал изложен очень подробно, все объясняется буквально на пальцах, важные тезисы по теме повторяются минимум пять раз, так что хорошо запоминаются в процессе чтения. Но как следствие, учебники имеют большой объем, в среднем 530 страниц А4 каждый. Всего 6 учебников.

Основные элементы экосистемы для обучения (Learning Ecosystem):

-

Онлайн тесты, около 3 000 вопросов. Вопросы сгруппированы по 19 подразделам учебника (Study Sessions). Онлайн тесты также содержат все вопросы, которые приведены в учебниках в конце каждой темы.

-

Словарь терминов. Очень большой по объему и примитивный в интерфейсе. Термины сгруппированы по темам учебников. К сожалению, нельзя сделать подборку избранных терминов.

- Пробный экзамен. Очень полезная вещь, но всего один вариант!

Также в Learning Ecosystem есть обучающие материалы в игровой форме: кроссворды, какие-то ребусы и т.д. Но мне вся эта геймификация не близка, и этим функционалом я совсем не пользовалась.

В целом Learning Ecosystem дает возможность хорошо подготовиться к экзамену.

Я расписала план изучения тем по неделям. План простой, изучаешь тему, решаешь тесты в Learning Ecosystem. Оценив объем материала и уровень моих стартовых знаний, я поняла, что нужно полностью погрузиться в материал. Читала учебники практически нон-стоп: до работы, на работе, вместо работы, после работы, на выходных, в метро, самолетах и поездах. Если что-то делала по дому, почти всегда смотрела лекции на youtube. Очень важны дисциплина и системность. Но мне было действительно интересно, в противном случае я бы вряд ли выдержала такой темп.

Идеальный муж

Муж с самого начала меня поддерживал. Мы начали заказывать наборы готовой еды, чтобы у меня было больше времени заниматься (с тех пор эти коробочки с едой прочно вошли в нашу жизнь: ) . Он спокойно отнесся к тому, что за месяц до экзамена я перестала что-либо делать по дому. Но и это еще не все.

Я не люблю что-либо заучивать и стараюсь жить по принципу «понять, значит запомнить». Муж все же убедил меня заучивать формулы наизусть и периодически спрашивал их у меня. Без этих выученных под его присмотром формул я бы вряд ли сдала экзамен!

К тому времени, когда оставалось всего полтора месяца до экзамена, я успела пройти все темы кроме Portfolio management (как всегда, факт не совпадает с планом) и… уже многое забыла из Quantative methods, на которые потратила так много времени в самом начале. Было ясно, что на изучение оставшихся тем уже нет времени. Надо повторять пройденное. Но как? Я прошла единственный пробный экзамен в Learning Ecosystem и разобрала все ошибки. Попробовала очистить все пройденные вопросы и решать их заново. Но это оказалось очень неудобно: не ясно с чего начать и как переходить от темы к теме, к тому же было ясно, что прорешать за месяц все вопросы, которые я решала последние полгода просто нереально. Все это деморализовало и заставляло паниковать. И тут на помощь снова пришел муж, по совместительству талантливый программист. Он собрал все вопросы, которые у меня были в электронном виде, и сделал аналог пробных экзаменов, получилось несколько вариантов.

Оставшееся время я учила формулы, проходила пробные экзамены и разбирала ошибки. За месяц я успела пройти 4 пробных экзамена. Это оказалось очень эффективно. По результатам пробного экзамена было понятно, где пробелы, и что надо повторить. Я также разобрала те вопросы по Portfolio management, которые попались мне в пробных экзаменах. Это помогло мне получить неплохой результат по данной теме на настоящем экзамене, хоть я ее основательно не изучала.

День Х

В моем случае контроль на экзамене осуществляли две добрые женщины зрелого возраста. Тем не менее протокол проверки достаточно жесткий: проверяют карманы, голенища сапог, рукава, ладони и т.д. В экзаменационную комнату можно взять только паспорт и калькулятор, а бумагу и ручку/карандаш нельзя, вместо них выдают ламинированные листы и фломастеры. В процессе экзамена надо не забывать вовремя закрывать фломастеры, иначе они перестают писать. Экзаменационная комната оборудована камерами видеонаблюдения, наблюдатели также смотрят за студентами через большое прозрачное стекло и периодически ходят по экзаменационной комнате.